With Fewer Government Payments, USDA Forecasts Farm Income to Fall in 2021

USDA’s first look at farm income shows without continued ad hoc government payments, which reached a record last year, net farm income will drop this year.

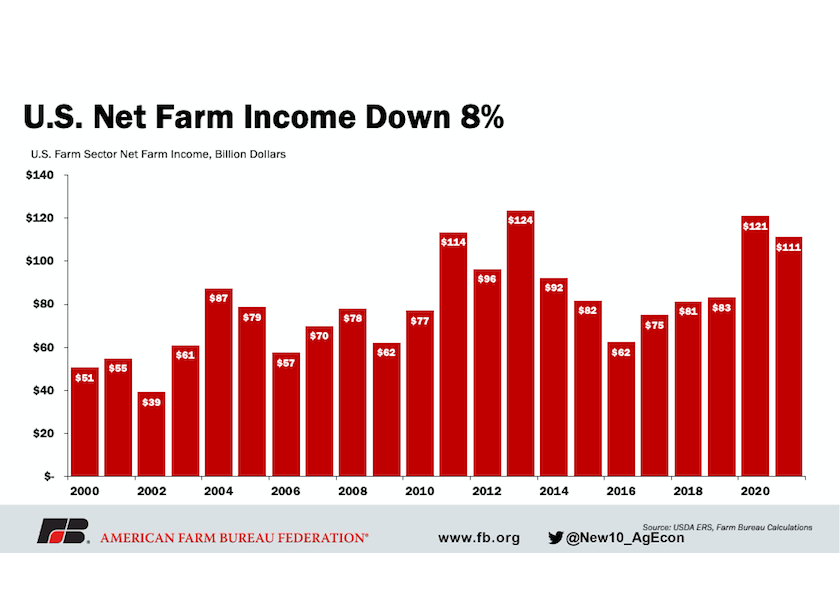

In its February 2021 Farm Income Forecast released Friday, USDA said it expects net farm income to drop 8%. With fewer government payments expected, USDA is forecasting net farm income to to fall $9.8 billion in 2021. The expectations come on the heels of net farm income hitting the highest mark in nine years. USDA says 2020’s net farm income final tally came in at $121 billion, which was the highest since 2013, and supported by record government payments to farmers.

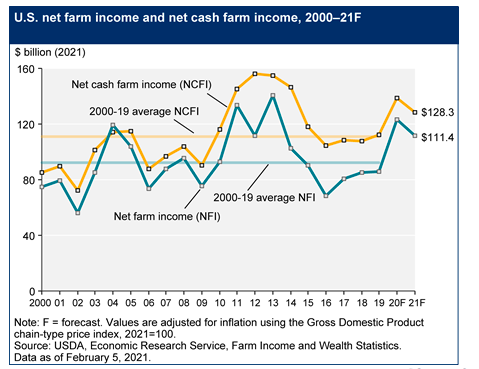

While net farm income is forecast to drop this year, USDA points out its forecast would still be 21% above the 2000-2019 average net farm income of $92.1 million

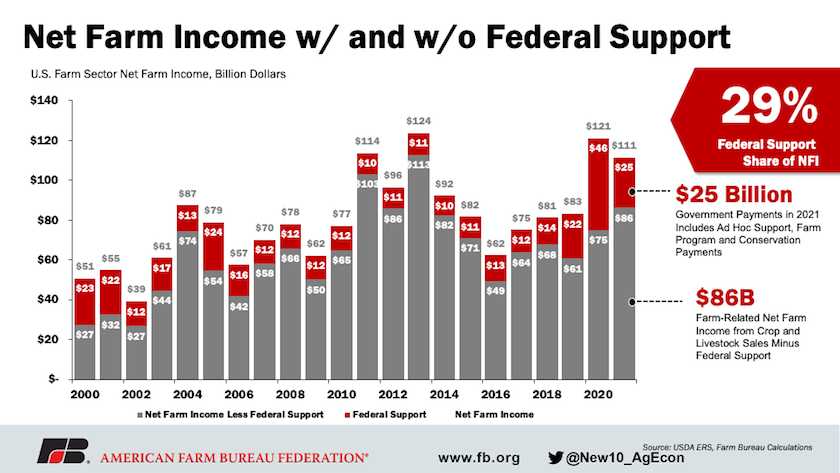

“The biggest driver of USDA’s drop in expected farm income in 2021 is a halving of the direct government payments compared to 2020,” says Jackson Takach, chief economist with Farmer Mac.

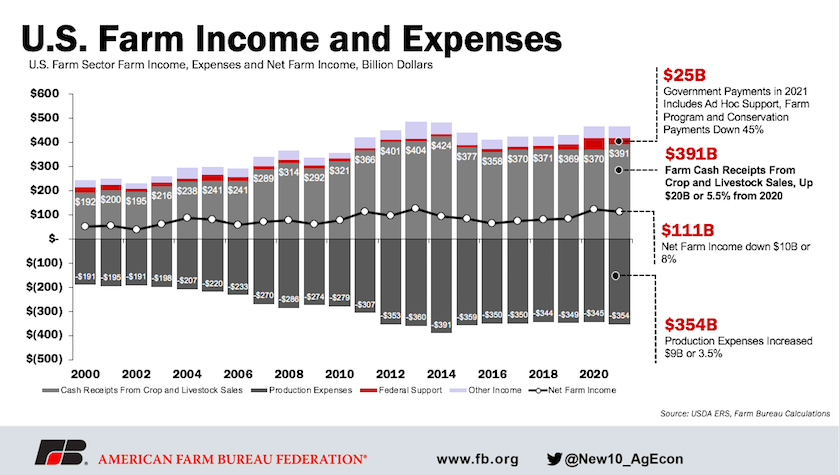

The news comes as farmers are staring at prices they haven’t seen in six to seven years for crops like corn and soybeans. USDA says despite the forecast for cash receipts to increase in 2021, government payments to agriculture reached an all-time high in 2020, and a projected drop in those payments could drive the total farm income forecast lower this year.

“Of the $46.3 billion in total government payments in 2020, USDA reports that $32.1 billion were ‘supplemental and ad hoc disaster assistance,’ says Pat Westhoff, director of the University of Missouri’s Food and Policy Research Institute (FAPRI). “I believe that would include MFP, CFAP, the Paycheck Protection Program, WHIP, and perhaps some other disaster aid payments.”

Westhoff says the drop in net farm income this year was expected. Coming off record high government payments last year, Westhoff knew it would be difficult for increasing commodity prices to make up for the loss of payments from Washington.

“Just from an accounting standpoint, the projected decline in net farm income results from a sharp reduction in government payments and a modest increase in production expenses,” says Westhoff. “These more than offset projected increases in cash receipts for both crop and livestock producers. Last year’s government payments were at a record high. Even with a sharp reduction in 2021, payments remain high by historical standards.”

USDA’s forecast also points to overall cash farm income trending lower, which encompasses all farm cash receipts, including government payments, minus expenses. USDA expects net cash farm income to fall $7.9 billion, or 5.8% in 2021. This comes as net cash farm income increased $27.3 in 2020.

Commodity Prices Could Help Improve Farm Income Picture

What could change the direction of the net farm income picture in 2021? Wehstoff says commodity prices continuing to trend higher could help.

“A fairly modest further increase in commodity prices could be enough to keep net farm income near the 2020 levels,” he says. “With projected net farm income down by $10 billion, it would only take a 3% increase in crop and livestock receipts to hold net income at the 2020 levels.”

Farmer Mac says even if commodity prices remain steady, the net farm income picture for 2021 could still improve.

“Grain commodity prices don’t need to rise to elevate USDA farm income measures back to 2020 levels, but they do need to hold at current levels,” says Takach. “There is some conservatism built into early projections like the USDA’s, knowing that prices are variable throughout the year. But if the current levels hold, the farm income picture in 2021 will likely be better than USDA’s February projections.”

February Forecast Is Far from Final

Just as USDA entered 2020 with a forecast that didn’t show the impact the COVID-19 pandemic would have on agriculture, economists caution so much can still happen this year to change USDA’s final net farm income numbers.

“This early in the year, I like to think about events that can shock supply and demand,” adds Takach. “Weather conditions will likely be a major wildcard, particularly when global supplies are low like they are today. The biggest demand driver in 2020 was in the export markets – that could also unwind in 2021 if China slows its purchases. Finally, disruptions to the food supply chain could cause more trouble for our protein sectors. We learned just how sensitive and strong our food supply chain was in 2020, and we still aren’t out of the woods from COVID-19.”

“As we learned last year, markets can be very volatile,” adds Westhoff. “Two major sources of the recent strength in markets are also major sources of uncertainty for the future. Will China keep up its buying spree? What will the weather be like in the U.S. and in other major trading countries? And, of course, how will the pandemic affect people’s lives, buying habits and the general economy?”

As the market volatility continues to take shape in today’s commodity markets, Wells Fargo Ag Economist Dr. Michael Swanson says 2021 could also pave the way for opportunity.

“2021 will be a year of opportunity for U.S. agriculture and agribusinesses,” says Swanson. “Higher prices at the farm level represent an opportunity for producers to strengthen their financial futures. Wells Fargo will be working with handlers and food manufacturers as they pass those costs through to the final consumers. Fortunately, these levels are not disruptive for the consumer making it a balanced outlook.”

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon