USDA’s acreage report not always the final say

USDA’s National Agricultural Statistics Service publishes its Prospective Plantings report on March 28, which will provide markets with the first farmer-informed look at how 2024 planted acreages could shake out. That’s a nice way of saying that the March Prospective Plantings report always generates a lot of price movement following its release.

Emotions are already running high across the Heartland heading into the 2024 planting season as many row crop producers face increasingly tight profit margins for the first time in three years. As of early March, new crop corn prices had fallen 12% (-$0.64/bushel) since late October 2023, when many 2024 acreage decisions were made in the Corn Belt. New crop soybeans fell nearly 18% (-$2.44/bushel) lower between mid-November 2023 and early March 2024.

The recent price losses could play a significant factor in how planting intentions shake out, in addition to causing further emotional distress for farmers. But how much stock should farmers put into the March acreage numbers?

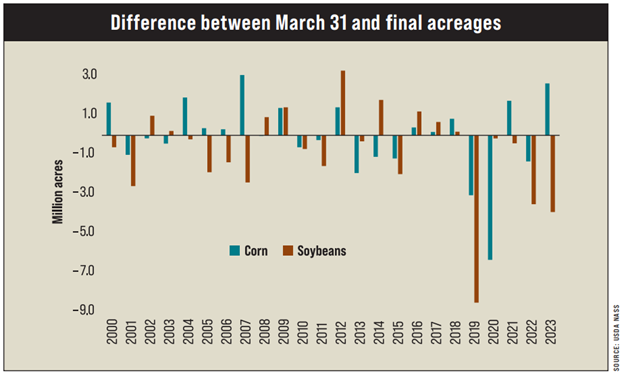

When comparing the past 24 years of USDA’s March Prospective Plantings and final acreages for corn and soybeans, the first thing that pops out is how consistently planting intentions change between pre-planting and final harvest. During that time, there has not been a single year that the March acreage intentions matched with post-harvest reports for corn or soybeans.

For corn, USDA is exactly 50-50 on making upward (or downward) changes to intended acreages by the end of the growing season. In the 12 years USDA has revised corn acres higher, it has done so by an average of 1.3 million acres. Downward revision years have changed by an average of 1.4 million acres.

Over the past 24 years, USDA has been more likely to find more soybean acres following the Prospective Plantings report. During that time, USDA has revised soybean acres higher in nine years by an average of 1.2 million acres. The remaining 15 years saw downward revisions averaging 2.0 million acres.

The size of the changes from March to final acreages has also increased, especially over the last five years. That is a pure reflection of rapid market changes due to weather, pandemic and geopolitical events.

Farmers should be ready for the Prospective Plantings acreages to change about as quickly as they are announced. A key driver of last-minute acreage shifts will be the success of Brazil’s safrinha corn crop, which hangs in the balance of weather forecasts. If Brazil receives enough rain through March and April, global corn stocks will continue to swell, dropping prices and potentially altering rotations in the Corn Belt’s fringe.

Smaller grains and other oilseeds are also going to compete with corn and soybean acres this year. In the Northern Plains, corn acres may end up losing ground to expanding soybean crush capacity and competitive spring wheat pricing. The market needs more soybeans, but too much soy or corn on March 28 could keep bearish pressure alive in the markets.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon