Sharp fall in UK pig breeding herd to lowest level in 20 years

The UK’s overall pig breeding herd has contracted by more than 15% demonstrating the impact of the tough conditions the pig sector faces.

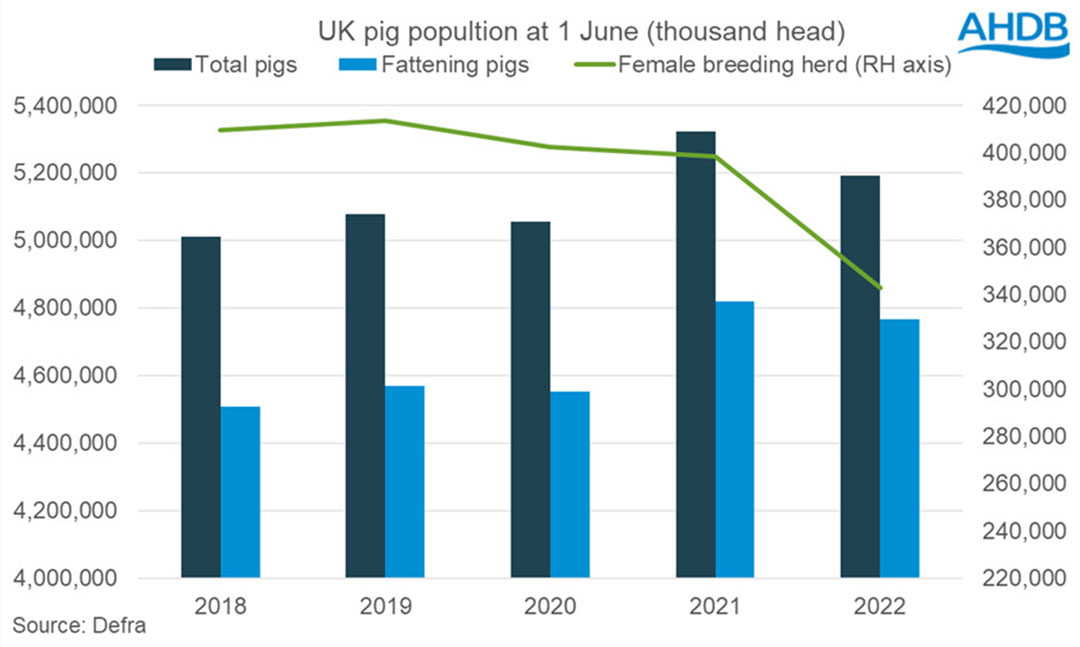

Figures released in Defra’s annual livestock census, show that at June 1st, the pig breeding herd in the UK had slumped by 15.2%, driven by the loss of 56,000 sows (-14%) in the female breeding herd which stands at 342,800 head, the lowest level in more than 20 years. The number of sows and gilts also declined by 11.7% and 22.4% respectively, with the number of gilts intended for first time breeding down 21.3%.

AHDB livestock analyst Freya Shuttleworth said: “These sharp drop offs in numbers demonstrate the impact of the tough conditions, with producers leaving the industry or contracting their herds in response to continued negative farm margins.”

The number of fattening pigs has seen a decline of 54,000 herd (-1.1%) to 4.77m head while the total pig population has fallen 2.5% in 12 months, to 5.19 million head.

The sector has endured a substantial period of pain and prices are still below the cost of production. The EU-spec standard pig price (SPP) crawled above the 200p/kg for the week ending 10 December but producers are estimated to be losing between £23 and £29 a pig for slaughter during November, according to AHDB figures, with the cost of production estimated at 232p/kg.

Falls in wheat prices have been offset by increases in interest rates, while energy and fuel costs remain high. Wheat prices remain below £240/tonne, which while still high, is better than recent months.

Pig sector analyst and consultant Peter Crichton said UK weekly contribution prices remained at last week’s levels with Woodheads at 180p/kg , Cranswick at 178p/kg and Karro at 165p/kg. This is an average of 25p/kg below the SPP and still “a country mile below current market prices.”

Pig producer Anna Longthorp said pressure on farmers was still immense and had been going on for a long time with an ongoing inbalance of power between retailers and producers. “We thought it would be over by now, but it is like we are being pummelled. These big supermarkets consistently make mega profits, while farmers have been losing money for 2 years, so there is plenty of money in the supply chain. It is a case of distributing that fairly.”

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon