Russia Wheat Exports Nearly Double What They Were Before War

After a slow start to the season, Russia’s grain exports are booming as buyers load up on its attractive bumper supplies.

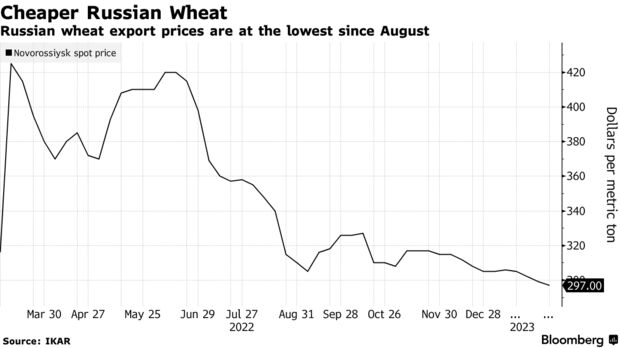

The country’s shipments of wheat — its main crop — almost doubled in January and February from a year earlier, Logistic OS data show. Buyers shunned cargoes earlier in the season when prices weren’t as appealing, but are now returning as last year’s massive harvest helps Russian grain to rank among the cheapest globally.

The recent boom shows shippers have overcome some of the financing and insurance problems fueled by sanctions on Russia. The outlook for exports from the Black Sea is also coming into sharper focus as a deal allowing Ukrainian cargoes to sail through a safe corridor comes up for renewal in about two weeks. Supplies from both nations are helping to stop global food inflation worsening.

Ukraine, whose exports are far behind last season, wants to extend the grain deal by at least a year. Russia says it can only be prolonged if its agricultural firms’ interests are taken into account.

There’s currently plenty of demand for Russian grain. Its seaborne wheat shipments in January and February totaled 6.1 million tons, about 90% more than the year-earlier period, according to ship lineups from Logistic OS.

Wheat futures have fallen to the lowest in at least a year in Chicago and Paris, and the big Russian volumes could cap prices for the rest of this season, according to Rabobank. The market generally expects the deal that runs until March 18 to be renewed successfully, it said.

Food hasn’t been included as part of sanctions on Moscow over its invasion of Ukraine, but restrictions on banks and state companies have made trade more complicated. Though hundreds of thousands of tons of Russian fertilizer remain frozen in European ports, exporters have been able to ship out huge amounts of grain.

The recent strong exports are also due to sales booked later than usual toward the end of 2022, when Russian wheat regained its competitive edge, said Andrey Sizov, managing director of consultant SovEcon.

“The start of the campaign was slow, taking into account the bumper crop and the huge supply,” Sizov said. Russia has shipped 29.5 million tons of wheat so far this season, compared with 26.7 million tons a year earlier, he estimates.

While Ukraine’s volumes remain significant, they’re below peaks set late last year. The amount carried out of the Black Sea in February totaled 3.35 million tons and the number of vessels cleared for inspection — a part of the deal — fell for a fourth month.

Inspections of Ukraine Crop Ships Hold Below Earlier Peak

Number cleared in February fell for fourth straight month

Source: Black Sea Grain Initiative

Note: Inspections were temporarily conducted without Russian involvement when it stepped back from the deal in late October; it resumed in early November

Kyiv has blamed a slowdown in its exports since late last year on sluggish work by Russian ship inspectors, who are one of the parties tasked with checking all vessels sailing under the deal.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon