Rabobank’s Winter Crop Outlook forecasts big lift in wheat area

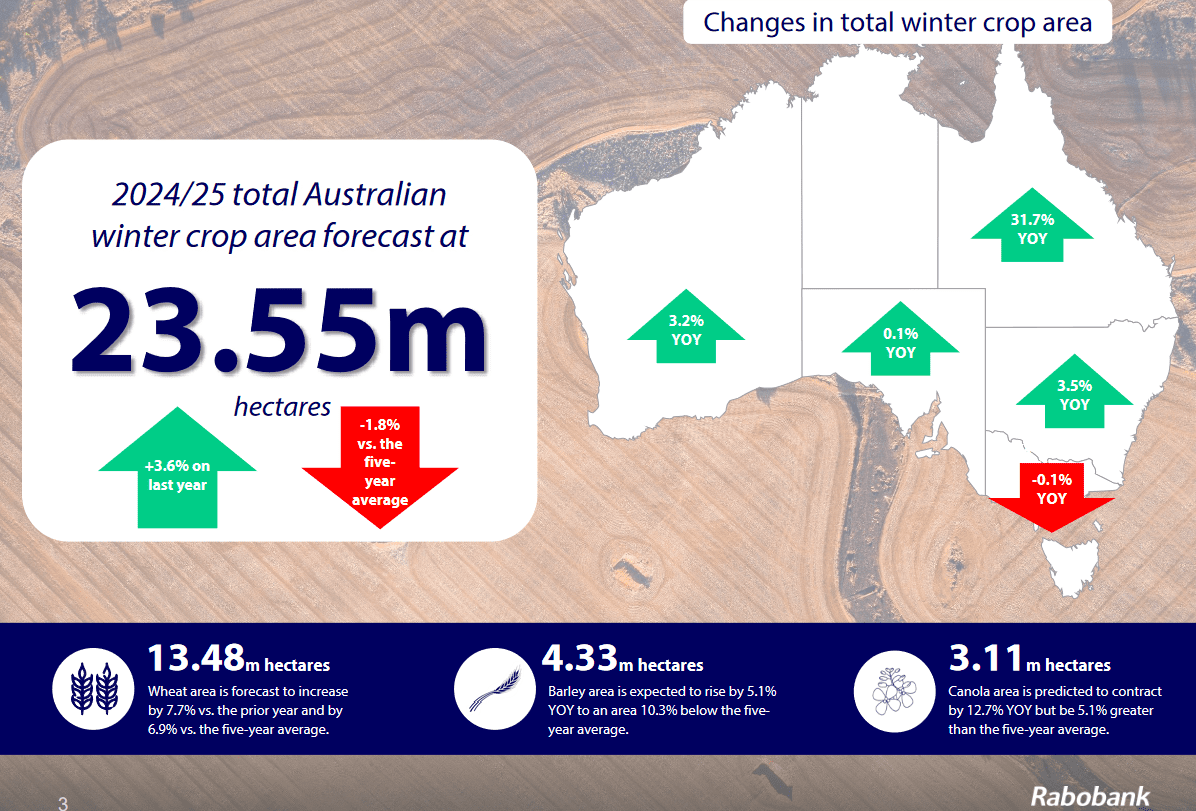

Australia’s 2024-25 winter crop now being planted is forecast to cover 23.55 million hectares (Mha), up 3.6 percent from last season, according to Rabobank’s Winter Crop Outlook released June 3.

The increase comes largely on the back of a positive outlook for New South Wales and Queensland and better margins year on year, and will favour wheat, while canola will drop around 450,000ha from 2023-24.

Total planted area for the winter wheat crop will surge 961,000ha, or 7.7pc year on year, to 13.48Mha.

Barley will likely take second place in the expansion, with an estimated 5.1pc, or 210,000ha, rise to 4.33Mha.

“It’s currently a ‘tale of two coasts’, at least for the season’s start, with strong early sowing in the east, but a dry start in the west,” RaboResearch analyst and report author Vitor Pistoia said.

“Canola seems prone to giving hectares away, shrinking 12.7pc year on year to 3.11Mha due to dry conditions in Western Australia and South Australia, and lower potential gross margins compared to previous seasons.”

Oats area is forecast to rise 12,000ha to 700,000ha, while planting intentions for pulses suggest a lift of 5.2pc to 1.93Mha.

Figure 1: Headline figures from Rabobank’s Winter Crop Outlook. Source: Rabobank

Rabo’s base-case scenario estimates a total production of 46.3 million tonnes (Mt), and assumes a tough start for WA, SA, and western Vic with a mid to late-season recovery following better rainfall due to La Niña.

“The significant expansion of wheat area projected for this season accounts for the skewed trend between wheat production and other crops.

The base-case scenario total comprises:

- Wheat 27.4Mt, up 5.7pc year on year;

- Barley 10Mt, down 7.2pc yoy;

- Canola 5Mt, down 11.4pc yoy;

- Oats 960,000t, down 6.1pc yoy;

- Pulses 2.8Mt, down 10.8pc yoy.

According to the mid-May update from the Bureau of Meteorology (BOM), there is a 50pc chance of neutral or La Niña conditions bringing above-average rainfall to the eastern half of Australia by the end of 2024.

“Overseas climate agencies such as the National Oceanic and Atmospheric Administration in the US and the UK Meteorological Office point to La Niña conditions as early as September 2024,” the report said.

“The short-term rainfall forecast gives us confidence that, from June onward, rainfall patterns will benefit winter crops in Qld, NSW, and Victoria.

“This should allow east-coast yields to be close to the five-year average, even with western Victoria’s late start.

“Unfortunately, for Western Australia and South Australia, the outlook raises concern.”

This is based largely on the Indian Ocean Dipole (IOD), which is expected to remain in a positive phase until September, meaning clouds will keep being pushed away from western and southern Australia toward the Middle East and eastern Africa.

Hence, Rabo’s base-case scenario assumes a negative impact on WA and SA yields compared to the past five years’ average, especially for canola, because a late-season break impacts canola more than cereals crops from a yield-potential perspective.

“In an upside scenario, if La Niña comes earlier and the IOD weakens, we could see a production boost of 17pc compared to the base-case scenario.”

However, Rabo’s downside scenario, with weather conditions remaining harsh for WA and SA and the east coast receiving average rainfall at best, production could fall short of the base case by 19pc.

Production nears average on the back of a forecast La Niña and a dry start in the west

Rabobank is a key financier of high-level Australian cropping operations, and its clients have indicated their intentions to expand on-farm storage are dissipating

“In the last couple of years, the logistics sector has improved its ability to handle larger crops, reducing the need to increase on-farm storage further.

“Opportunities still exist for local aggregators’ silos or those involved with special grades of grain.”

Rabo’s Australian network has also determined that carryover of grain into the current sowing period has been significant.

“The current carryover is impacting wheat basis and is poised to change after the end of the financial year on 30 June 2024, when new market strategies can be implemented from a tax income perspective.”

Rabo’s report said grower procurement of inputs is slower compared to last season, which had better soil-moisture profiles than this season.

“The current procurement slowdown aims to optimise working capital in the face of weather uncertainties.”

Fertiliser application rates are expected to follow the weather outlook and early-season moisture profiles, with year-on-year increases for Qld and NSW.

Following is Rabo’s round-up of conditions by state:

Qld’s area planted to pulses is expected to rise 17pc to 275,000ha, mainly in the Border Rivers and Condamine regions.

The Indian Government’s removal early last month of tariffs on chickpeas, Qld’s major rotation crop, as well as mostly ideal seasonal conditions , are behind the lift.

While well below the record 556,000ha planted in 2016-17, Qld pulse area looks like being 71,000ha above the median of the past 20 years, and wheat area is also up substantially.

“If the intention to plant 1Mha is realised, it would be the largest wheat area Qld has ever farmed.

“The Border Rivers region will lead the way, with more than 710,000ha.

“This represents a 50pc year-on-year increase, supported by good soil-moisture levels, increasing prices, and reduced area in the 2023-24 season.”

In NSW, northern regions are starting the season with good levels of soil moisture, similar to areas in Qld.

“In contrast, the southern part of the cropping belt is not experiencing the same tailwinds, leading to uneven confidence about the seasonal outlook at the state level. “

All crops bar canola are predicted to increase their area year on year.

“In addition to the challenging soil moisture conditions down south, the outlook for canola margins is not as good as those of other cereals, pushing farmers across the state to choose wheat and barley instead.

In north-west NSW, Rabo estimates wheat area could jump 25pc from 2023-24 to boost the state’s wheat area by 147,000ha.

“Given the year-on-year reduction in canola area due to the crop’s comparatively lower margin outlook, the relative importance of the Murrumbidgee and Murray areas for canola production will increase this season.

“Canola is a fundamental component of crop rotation design in these regions and has better yield potential there due to the southern latitude.”

Planted area in Victoria is forecast to remain steady at 3.5Mha, potentially the second-biggest winter area ever cropped and just 1.4pc under the 2020-21 record.

However, figures from the past 20 years indicate a median of 3.39Mha, meaning winter-crop area in Victoria is largely consistent throughout time, regardless of weather and market conditions, with a large population, proximity to ports, and strong demand for animal feed some of the reasons.

“The crop rotation, however, is likely to change substantially.

“In line with the national forecast, canola area in Victoria will likely make room for other crops, mainly barley.

Vic’s expected drop in canola area will mark the second consecutive contraction for the crop.

Unlike other states where the crop’s risk profile is fundamental for decision-making, crop rotation is the driving force in Vic, which has the highest canola yield and long-term average potential of any mainland state.

Vic is forecast to plant 1.54Mha of wheat, its third consecutive season to breach 1.5Mha.

“The last time this happened was during the 2011-2013 period, which was also marked by above-average wheat prices and good seasonal rainfall.”

SA’s winter-crop area is not expected to change overall this season, but is expected to show a significant drop in canola and an increase in pulses.

“The outlook for lower canola margins and the significant delay in the season’s break are the core reasons behind the shifts.

“In contrast, wheat and barley – crops with lower risk profiles for challenging scenarios – will stay roughly the same year on year, dropping a combined 15,000ha.

The Murray-Mallee will show the biggest reduction in cropping area across the state, shedding up to 2.1pc, or 15,000ha, from 2023-24.

“On the other hand, the northern region is about to add 20,000ha, mainly in pulses production.

SA’s biggest cropping area, Eyre Peninsula, is forecast to plant the same area as last year, over 1.3Mha, with wheat comprising 70pc.

EP canola area is forecast to drop its canola area by 25pc, or 23,000ha, from last season.

“Canola will be replaced almost exclusively by pulses, reaffirming farmers’ preference for crop rotation as a best practice.”

Overall in SA, Rabo calculates the compound annual growth rate of canola areas since 2019-20 at 6.9pc, four times that of canola for the same period. The 560,000 hectares forecast would be the largest area ever.

“These facts illustrate South Australia’s efforts to develop the industry and the availability of ports suitable for container and bulk exports of pulses.”

Despite a delay in the season’s break, WA is on track to increase its cropping area by 275,000ha, a 3.2pc rise from last season, to 8.905Mha.

“Crops’ margins are in a better position compared to last year, and paddocks that went fallow will re-enter cropping programs.

“Because of the dry start and each crop’s risk profile, canola is expected to give away 351,000ha and pulses another 20,000ha, mainly to wheat. “

The drop in WA’s canola area represents 77pc of the crop’s national reduction, which will change the exporting profiles of the coasts.

Within the state, Albany will have the same winter area as in 2023-24, and Kwinana and Geraldton will increase area by approximately 3.8pc each.

The Esperance region is on track to rise 2pc year on year.

Because of the impacts of late sowing and germination on yields, canola area for 2024-25 will shrink in all WA farming regions.

Albany will have the smallest drop, down 23,000ha, and Kwinana the biggest, dropping 172,000ha.

In relative terms, Geraldton will shed 50pc of its area.

The late break of the season will also lead to a partial reduction in lupin area and an extra push for wheat.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon