Palm oil stocks in Malaysia fell to a 6-month low

Malaysia’s palm oil stockpiles fell more than expected to the lowest level in six months at the end of January as production fell to the lowest level in nine months amid steady exports, the industry regulator said on Tuesday.

Reducing inventories in the world’s second largest palm oil producer after Indonesia would help support benchmark futures, which have lost 10% in 2023.

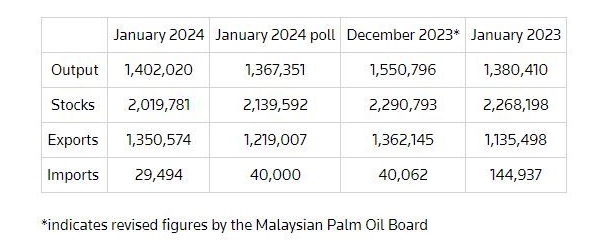

Palm oil stocks at the end of January fell 11.83% from the previous month to 2.02 million metric tons, the lowest since July, according to data from the Malaysian Palm Oil Board (MPOB).

Crude palm oil production fell 9.59% from December to 1.40 million tons in January, the lowest since April, while exports fell 0.85% to 1.35 million tons, MPOB said.

A Reuters poll forecasts January stocks at 2.14 million tons, down 6.62% from the previous month, with production at 1.37 million tons and exports at 1.22 million tons.

The MPOB report is a bit optimistic, as stocks fell more than expected, but production is not declining at the pace the market was discussing, said Anilkumar Bagani, head of research at vegetable oil brokerage Sunvin Group.

Several traders had expected production to fall to 1.3 million tons in January, but production did not fall at the pace the market had expected, a New Delhi-based trader said.

Palm oil exports are expected to decline in the coming months as competing oils become available at competitive prices, offsetting the likely drop in production, the trader said.

Palm oil price gains are likely to be limited by abundant supplies of competing soybean and sunflower oils, “soft” oils that are available at discounts to tropical palm oil for the first time in more than a year, industry officials said last week.

Below is a breakdown of the MPOB and Reuters estimates for January (volumes in tons):

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon