India’s palm oil drive faces reality check

Palm oil has become essential to India’s food security in the past three decades, replacing other edible oils such as groundnut. About 90% of the 8.5 million tonnes of palm oil consumed in India is used in food or as cooking oil.

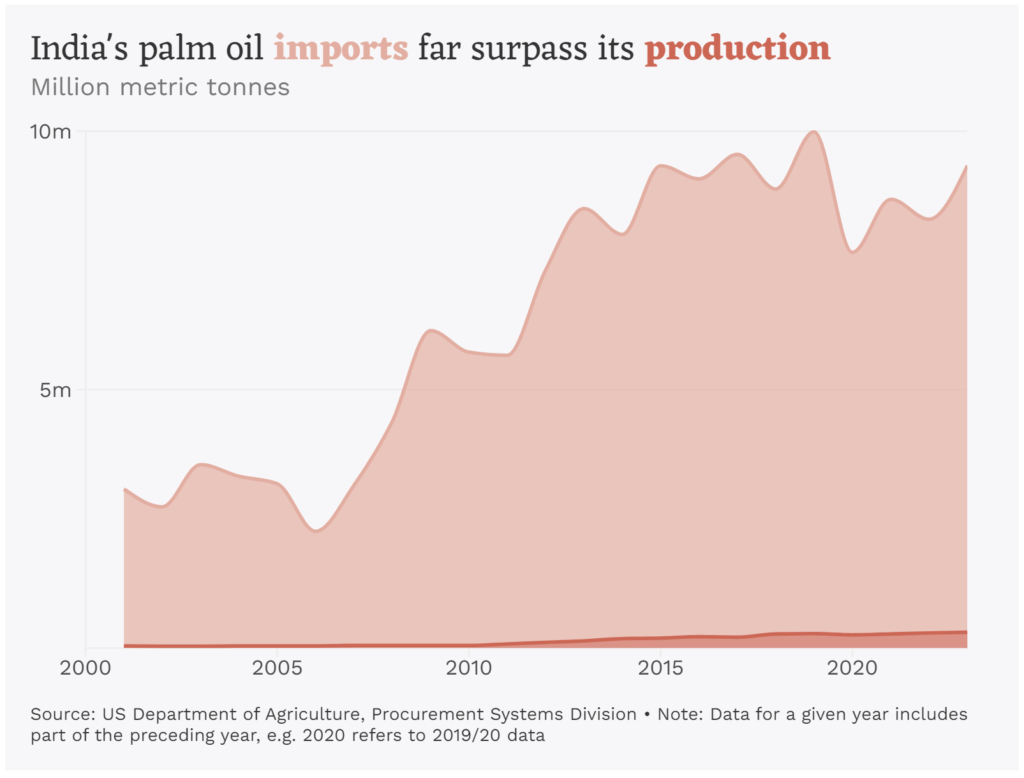

Today, India is the world’s second-largest consumer of palm oil after Indonesia, with one crucial difference: Indonesia produces most of the palm oil it consumes, while India produces nearly none. It spent US$8.72 billion on palm oil imports in 2021.

In the same year, the Indian government set out to reverse this trend by encouraging farmers to grow oil palms, a potential win–win for local agriculture and the economy. It announced a nationwide campaign, the National Mission on Edible Oils – Oil Palm, that promised subsidies for fertilisers and support for the sector at large, including setting up irrigation systems and processing mills.

In 2019–20, India produced 270,000 tonnes of palm oil from 350,000 hectares of plantations. The mission aims to increase this to 1.12 million tonnes across 1 million hectares by 2025–26, and to 2.8 million tonnes across 6.6 million hectares by 2030.

But progress has been slow. Government responses to right to information requests by China Dialogue revealed that 14 of the 22 states slated for increased oil palm cultivation do not have mills to process fruits into palm oil, and that area-wise palm oil expansion targets were not met in 2021–22 or 2022–23.

Oil palm fruits are highly perishable. They need to be crushed within two days of harvesting and ideally within one. The fact that many states do not have mills at all is therefore cause for concern.

It also seems like little is being done to set up any additional mills. In its response to China Dialogue, the government stated that new mills are being established in Arunachal Pradesh and Assam, while twelve states that do not yet have any of these facilities remain without prospective developments.

Progress on area-wise expansion has also been unimpressive. In the first year, 72% of the 29,422-hectare expansion target was achieved, while just 36% of the 2022–23 target was met (excluding the last month of March).

Experts have also raised concerns over the climatic conditions of some of the target areas. For example, in the north-east the plan proposes to rely on rainfall rather than irrigation. But annual rainfall in the region is lower than the 2,000–2,500 mm the crop would ideally get, and is not distributed evenly throughout the year. Climate change adds to the uncertainty. Research shows that the total rainfall in the region has decreased in the past 50 years, while the frequency of extreme rains has increased.

Siraj Hussain, former national agriculture secretary, told China Dialogue that the inclusion of states like Bihar and Uttar Pradesh in the expansion plans is “aspirational”. In the short term, it is unlikely that production will take off here, he said, because climatic conditions like rainfall patterns and humidity are not conducive to cultivating oil palm. The relevant state governments are also not as enthusiastic about providing subsidies for inputs like fertilisers and support for irrigation facilities, he added. Currently, they do not produce any palm oil.

Anupam Barik, a former commissioner with India’s agriculture ministry, said various states including Madhya Pradesh, Maharashtra, West Bengal, Bihar and Uttar Pradesh, have not been enthusiastic about the crop’s expansion.

Due to these uncertainties, profits for farmers who choose to switch to oil palm may not be guaranteed. Hussain said that, with such risks in mind, “the experience of farmers in states like Andhra Pradesh and Telangana [where oil palm cultivation has taken off] will be keenly watched,” At around 300,000 tonnes of palm oil per year, the state of Andhra Pradesh is the country’s largest palm oil producer.

The presence of processing mills close to plantations is essential for a functioning supply chain, given the limited shelf life of the oil palm fruit. States located close to others with milling capacities and appropriate transportation facilities, such as Odisha, which shares a border with Andhra Pradesh, can still get the fruit processed in time. But what happens when the mills are saturated with the produce cultivated in the state? Some states, like those in the north-east, lack both milling capacity and road infrastructure to transport the fruits on time.

In order for a mill to be financially viable, “whoever is setting up a mill has to ensure that sufficient quantities of palm oil are grown,” said Hussain.

A processing mill entails heavy capital investment. And mill owners usually ensure that at least 5,000 hectares are under palm oil cultivation before they make such investment decisions. Even with all the right conditions in place, it can take about eight to 10 years for a mill to become profitable.

This can lead to a catch-22 situation where farmers are wary of growing the crop unless there are mills in their vicinity, and businesspeople are wary of setting up mills until they are assured there will be enough fruit to process.

In many cases, this is where state governments intervene to help secure land and provide other incentives for setting up the necessary mill infrastructure. The mission guidelines outline specific state government support for setting up mills in the north-east region, but it remains to be seen to what extent such interventions succeed.

A report published in 2020 by the Indian Institute of Oil Palm Research (IIPOR), which advised the government on its palm oil expansion plans, also notes the “negative impact” of the lack of processing facilities in certain oil palm growing states and recommends the “timely establishment” of new processing units.

Currently, palm oil growers in Arunachal Pradesh send their fruit bunches to Andhra Pradesh for processing. But the length of the journey impacts the amount and quality of the oil extracted from the fruits. Barik explained that, broadly, fruits processed within 24 hours yield around 20% of their mass in oil. Within 36 hours, and the oil extraction rate drops to around 16%. For 48 hours, it would be around 12%. In some areas, the lack of milling facilities has given farmers little choice but to leave their fruits rotting in the field.

Bipul Kumar Srivastava, deputy commissioner for India’s agriculture ministry, declined to respond to queries about the lack of supporting infrastructure and facilities. A detailed set of questions were also sent to Shubha Thakur, joint secretary under the same ministry. She has not yet responded.

Palm oil is a water-guzzling crop. But rainfall across India is seasonal, with the majority arriving between June and September, making rain-fed cultivation unsuitable. And given how north-eastern states have inadequate irrigation facilities, palm oil cultivation here is very challenging, experts consulted by China Dialogue agreed.

States like Mizoram already experience chronic water shortage for several months every year. “Hundreds of trucks carry water from streams to households,” explained T R Shankar Raman, a wildlife scientist who has worked in the state. So, he added, the question is whether an already-scarce resource like water should be diverted towards growing oil palm, and to consider what impact such decisions would have on other water users, including households and farms.

The crop also grows best within a narrow tropical band 10 degrees north and south of the equator, where the climate is stable and humid all year round. But the north-east region of India is located around 26 to 27 degrees north of the equator, in the subtropical zone.

In Arunachal Pradesh, for example, temperatures can drop to as low as 10C even at lower elevations. High elevation areas – such as the Tawang district, which lies 3,000 metres above sea level and sees winter temperatures as low as minus 10C – are also listed by the government as regions with a potential for oil palm expansion.

“Andhra Pradesh is able to grow oil palm because of irrigation,” said Umesh Srinivasan, assistant professor at the Indian Institute of Science (IISc) in Bangalore, noting how the state, like much of India, has only monsoonal rainfall. It also has road infrastructure that makes oil palm production feasible. But the north-east region lacks both irrigation facilities and road connectivity, he said.

Overall, around 40,000 hectares in the north-east are currently under oil palm cultivation. The national palm oil mission aims to expand this by 328,000 hectares by 2026, nearly a ninefold increase. To achieve such growth, Barik explained that a dependence on rainfall alone would not be sufficient, and irrigation would be required for four to five months a year to support oil palm crops.

More broadly, climate change has significantly altered rainfall patterns across the country including in the north-east, but India’s oil palm expansion plans, informed by the 2020 IIPOR report, do not seem to factor in climate change. The report assesses the suitability of local climates by considering average rainfall between 1950 and 2000, but ignoring climate change-driven variations that occurred between 2000 and 2020.

“Since oil palm cultivation is planned for the near future, we need to also consider future changes from climate projections,” said Roxy Koll, a climate scientist with the Indian Institute of Tropical Meteorology.

The IIPOR report makes several recommendations on areas it deems unsuitable for oil palm cultivation due to climatic concerns. These include severe droughts in certain parts of Karnataka that could lead to high crop mortality, and villages in coastal Andhra Pradesh that are prone to storm surges and cyclones, and associated water logging.

However, the national mission plan lists many of these same locations as having potential for expansion, including drought-prone districts of Karnataka, such as Belagavi, Dharwad and Kalaburagi, and coastal areas of Andhra Pradesh, such as East Godavari and the city of Visakhapatnam.

And while the plan outlines a map of target districts, it does not provide a granular analysis of the environmental situation of each area.

“It’s not fully clear which exact areas are earmarked for oil palm cultivation,” said Aparajita Datta, a senior scientist with the nonprofit Nature Conservation Foundation. “What is their legal status and ownership? What is the state of the forest cover in those areas?”

In the north-east, many areas of land are community-owned, as opposed to under state or private ownership. “If these lands are taken over by companies for oil palm plantations, communities will be forced to become labourers on their own land, like what has happened in Indonesia and Papua New Guinea,” the IISc’s Srinivasan suggested.

Srinivasan is lead author of a recent study that identified 16 million hectares of rice fields with low yield (less than 2 tonnes per hectare) in peninsular India that could be suitable for oil palm cultivation. The study stresses that “spatially explicit planning exercises” are needed to ensure that areas with high conservation value are not harmed while pursuing oil palm expansion targets, and a careful look at land tenures so that socioeconomic inequalities are not exacerbated, and livelihoods are not threatened.

These complex issues only add to the obstacles facing India’s palm oil drive – spanning its missing infrastructure, climatic unsuitability, and the lack of data needed for sound planning decisions. They raise serious concerns about its ability to ramp up domestic production to reduce reliance on imports.

“Palm oil is very versatile and it has very high yields compared to other oilseeds,” Srinivasan explained, referring to its range of applications, from cooking oil to soaps, cosmetics and pharmaceuticals. Then he concluded with a note of caution: “The plan to scale up oil palm is fantastic if you want to spare land and meet oil requirements. But we need to do this in a manner that does not destroy biodiversity, land tenure systems and cultures of different societies.”

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon