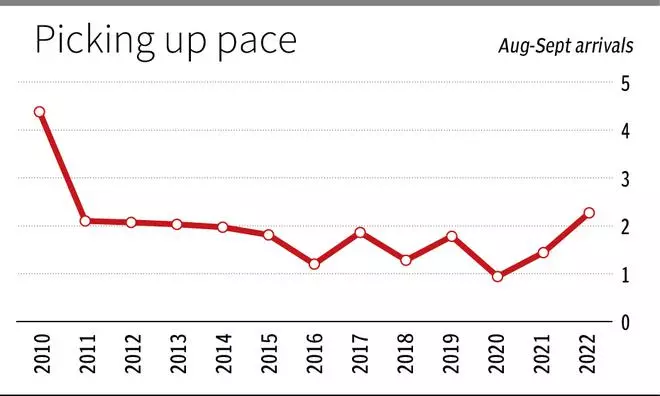

Indian wheat arrivals rise to 12-year high across markets in Aug-Sept

Wheat arrivals at various Agriculture Marketing Committees (APMCs) rose to a 12-year high in August-September this year, even as Food Corporation of India (FCI) stocks fell to a six-year low.

Data from Agmarknet, owned by the Ministry of Agriculture and Farmers Welfare, showed wheat arrivals in August-September were 57 percent higher at 2.27 million tonnes (mt) compared to 1.44 mt in the same period a year ago. Arrivals were the highest since August-September 2010, when 4.38 tonnes arrived.

India has only a few crops to meet demand and orders come from many markets

Arrivals between April, when the wheat harvest begins, and August reach a three-year high of 20.90 tonnes. In 2019, the intake for this period was 22.95 tons, and in 2020 and 2021 – 15.19 and 17.51 tons, respectively. FCI wheat stocks are 24.82 million tonnes, the lowest since 2016.

Lower purchases

“At the annual general meeting of the Federation of Flour Mills of India (RFMFI), the food minister said that wheat procurement was at least 25 million tonnes lower this year and they will have to enter the market. It is happening now,” said Pramod Kumar, President, RFMFI business line.

Wheat prices have practically stabilized. The weighted average price is Rs 2,304.52 per quintal, the same as in the first week of September. Last week, the highest price of wheat was at Khategaon APMC in Dewas district of Madhya Pradesh at Rs 2,480. The receipt of ATMK increased to 187.4 tons, which is more than 100 tons more than the receipt for the whole of August (74 tons).

At Hardoi APMC in Uttar Pradesh, wheat prices are now ruling at INR 2,300 after crossing INR 2,500 on August 13 and INR 2,400 on September 26. Fearing a shortage, they bought wheat at different prices and on different occasions,” said a miller from South India, who did not want to be named.

Fears for accessibility

“Wheat, which is delayed at the ports, is now reaching the markets, although demand is weak,” said MK Dattarai, managing director of The Krishna Group of mills.

“Concerns were rife about the availability of wheat during the festive season. Dussehra-Dasara is over and soon we will have Diwali. All major holidays will be over in a couple of weeks and we have no shortage of wheat. We do not expect any availability issues till December,” RFMFI President Kumar said.

“If wheat prices have risen at all, it is due to transport costs as fuel has become more expensive,” said a miller from the Southern region.

A New Delhi-based analyst said big farmers, who had been holding back their wheat in the hope of higher prices, also started releasing their stocks when the market showed no anxiety over availability or price.

Export demand

In May of this year, wheat prices exceeded 2,500 rubles per quintal, which became a record after export demand due to the war in Ukraine. Since Ukraine and Russia account for 30 percent of the world’s wheat trade, consumer countries such as Egypt have appealed to India to help them.

This led to FCI’s wheat purchases falling by more than 56 percent to 18.9 million tonnes this year compared to 43.44 million tonnes a year ago. In connection with this and in order to curb the growth of food inflation, the Center has banned the export of wheat since May 13.

Minkharch reduces 5.6 million tons of wheat for PDS, replacing it with rice

In addition to export demand, the wheat yield was affected by the rise in wheat prices due to the heat that swept through the country in March-April. This has led to a drop in wheat production from an initially estimated 111.43 million tonnes this year.

According to the fourth preliminary estimate of the Ministry of Agriculture and Food, wheat production will amount to 106.84 million tons against 109.59 million tons last year.

On a leash

The ban on Indian wheat exports lifted world prices to $12.77 a bushel ($469.16 a ton) on the Chicago Mercantile Exchange before falling to $8.95 ($328.82).

Prices have also eased in the domestic market, though they are still above the minimum support price of Rs 2,015 per quintal this year.

“We expect the Center to unload approximately 2-3 mt around December on the open market. This will keep the market on a leash and is likely to help till the new crop starts arriving in mid-February,” Kumar said.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon