How the Ukraine-Russia war affected sunflower oil consumption in India

Few commodities have witnessed as much price volatility over the last 2-3 years as edible oils.

The UN Food and Agriculture Organization’s global vegetable oils price index (2014-16 base period value = 100) plunged to a low of 77.8 points in May 2020 at the height of the worldwide Covid lockdowns.

It soared to an all-time-high of 251.8 in March 2022 after Russia’s invasion of Ukraine.

But by April 2023, it was down to a 29-month-low of 130 points.

Within the vegetable fats complex, the oil that has witnessed the highest price rise and fall in just the last one year is sunflower. Not surprising, given that Ukraine and Russia together accounted for nearly 58% of the world’s production of this oilseed in 2021-22. As the war shut off their supplies through the Black Sea ports, prices skyrocketed.

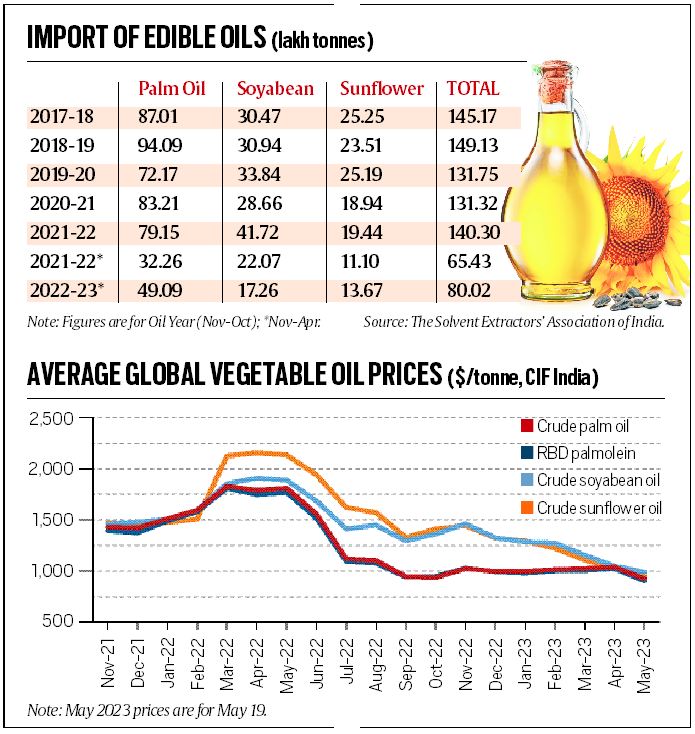

In January 2022, prices of crude sunflower oil imported into India averaged $1,475 per tonne CIF (cost plus insurance and freight). This was below the corresponding price of $1,506 for crude soyabean oil and $1,490 for RBD (refined, bleached and deodourised) palmolein.

By April 2022, the average landed price of sunflower oil, at $2,155/ tonne, was above the $1,909/ tonne for soyabean and $1,748/ tonne for RBD palmolein.

However, the situation changed with the Black Sea Grain Initiative agreement between Russia and Ukraine signed on July 22. The deal, brokered by the UN and Turkey, facilitated the safe navigation of vessels carrying grain and foodstuffs from three designated Ukrainian ports.

The opening of the corridor helped much of the sunflower oil, meal, and seed that had accumulated in Ukraine to be shipped out. It led to international vegetable oil prices falling below even pre-war levels. Sunflower oil is currently being imported at around $950/ tonne CIF India, less than the $990 of its immediate competitor soyabean (see chart).

What does this translate into for India?

India consumes 23.5-24 million tonnes (mt) of cooking oil annually, out of which 13.5-14 mt is imported and the balance 9.5-10 mt produced from domestically cultivated seed.

Sunflower is the fourth largest consumed oil (2-2.5 mt), behind mustard (3-3.5 mt), soyabean (4.5-5 mt) and palm (8-8.5 mt).

Both sunflower and palm oil are almost wholly imported, with their domestic production at hardly 50,000 tonnes and 0.3 mt respectively. This is unlike mustard and soyabean, where the share of domestic output are close to 100% and 30-32% respectively.

Thus, what the Indian consumer pays for edible oils is significantly dictated by import prices. The other locally produced oils — cottonseed (1.2-1.3 mt), rice bran (1-1.1 mt), groundnut (0.75-1 mt), and coconut (0.4 mt) — aren’t big enough to influence prices.

At $950 per tonne, the landed cost of crude sunflower oil in India would work out to about Rs 78.7/ kg. Adding 5.5% import duty and processing costs of Rs 6 (vegetable oil refineries are mostly near the ports) takes it to just over Rs 89/ kg.

Packed refined sunflower oil is retailing now at Rs 119-120/ kg in Chennai and Bengaluru, as against Rs 190-200 when import prices had shot up to $2,100-2,200 per tonne.

The table above shows India’s edible oil imports at 8 mt during November-April 2022-23, a 22.3% increase over the 6.5 mt for the corresponding six months of the previous oil year. At the present rate, total imports for this oil year (November-October) may well surpass the record 14.9 mt of 2018-19. The import surge has been led by palm and sunflower, which have gained at the expense of soyabean oil.

“When prices went through the roof, many households replaced sunflower with relatively cheap soyabean or even local oils. Institutional consumers such as restaurants, tiffin rooms and canteens that were using sunflower, likewise, switched to palm oil. But with import flows and price parity being restored, they are all coming back,” Pradeep Kumar Chowdhry, managing director, Gemini Edibles & Fats India Ltd., which manufactures the ‘Freedom’ brand of refined sunflower oil, said.

Until 2019-20, India was importing an average 0.2 mt of sunflower oil every month. This fell to 0.15-0.16 mt, first on account of the crop in Ukraine and Russia being hit by dry weather in 2020-21, and then the war-induced disruptions. Imports have rebounded to 0.25 mt in the last 4-5 months. And with prices easing, consumers are once again demanding sunflower oil.

India’s sunflower oil imports were valued at $2.88 billion in 2021-22 (April-March) and $3.12 billion in 2022-23. In quantity terms, imports were stagnant at 2 mt.

But within that, Ukraine’s share fell from 1.48 mt in 2021-22 to 0.43 mt in 2022-23, while that of Russia rose from 0.34 mt to 0.57 mt, Argentina’s from 0.19 mt to 0.43 mt, Romania’s from 0.02 mt to 0.2 mt, and Bulgaria’s from 0.02 mt to 0.16 mt.

Roughly 70% of the country’s sunflower oil consumption is in the South, with Maharashtra (10-15%) and other states making up the rest. One reason for this geographical skew has to do with sunflower being traditionally grown in Karnataka, Telangana, and Maharashtra.

“Habits are formed over decades. Consumers in these states were familiar with this oil, just as those in Madhya Pradesh and Rajasthan knew about soyabean that was already being planted there,” Chowdhry said. It’s another thing that domestic production of sunflower has fallen to insignificant levels over the last decade or so, unlike soyabean that has registered substantial expansion in cultivated area.

Chowdhry’s Hyderabad-based company is India’s largest importer and seller of branded sunflower oil. Other major players in the segment include Adani Wilmar (‘Fortune’), Chennai-based Kaleesuwari Refinery Pvt. Ltd (‘Gold Winner’), Srirangapatna (Karnataka)-based M K Agrotech (‘Sunpure’), and Hyderabad-based Lohiya Industries (‘Gold Drop’).

There are also multinationals such as Cargill (‘Gemini’) and ConAgra (‘Sundrop’), though their share in the refined sunflower oil market isn’t as big.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon