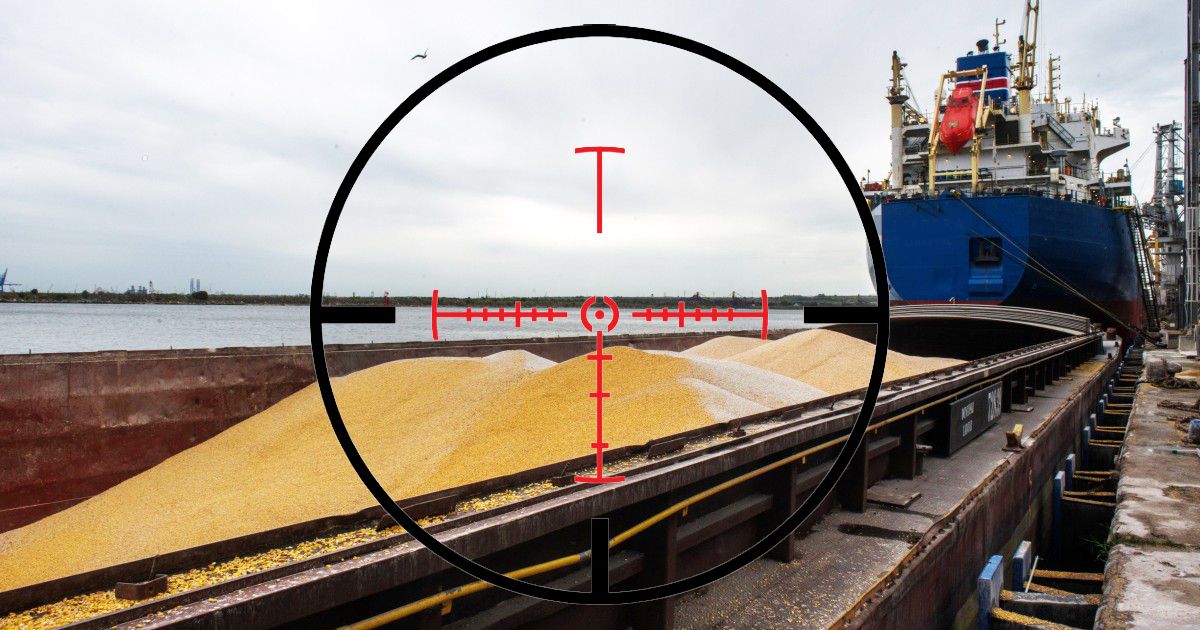

Grain Deal Scenarios: Market factors? Political and Geopolitical Influencers? Geo economic factors?

Article author:

The “grain deal” was signed at the end of July 2022. Later, on November 19, it was extended for another 120 days. The main purpose of this deal was to ensure safe sea logistics from Ukraine’s three Black Sea ports (Odesa, Chornomorsk, and Pivdenny) in order to reduce global food inflation. So far, the “grain deal” includes only the ports of Big Odesa because active hostilities still prevent the functioning of the Mykolaiv and Ochakiv ports.

The representatives of Russia resumed criticizing the “grain deal” last week:

- A too small share of needy African and Asian countries in total grain exports

- Unsatisfactory implementation of arrangements regarding the export of grain and fertilizers from Russia (quote from russia’s permanent representative to the UN General Assembly: “After more than half a year of the Russia-UN memorandum, not a single grain and almost nothing of fertilizers have been sent according to the memorandum.”)

Early 2022/23 season, Russian exports were indeed facing problems due to Western sanctions against the Russian banking system and restrictions on the movement of Russian vessels/vessels carrying Russian goods in European ports. But over time, the Russians learned to avoid the sanctions and switching the trade flows to more “friendly” countries (India, Iran, Turkey, Egypt).

To avoid queues in the Bosphorus, it is necessary to carry out 25 inspections per day, but in reality, the average number of inspections over the past three and a half months has been 3.2 per day due to delays of the Russian representatives.

UkrAgroConsult considers several scenarios for the grain deal after March 19, 2023

-

The “grain deal” will be extended and supplemented with the Mykolaiv ports

-

The “grain deal” will be extended and the pace of inspections will go faster

-

The “grain deal” will be extended but the pace of inspections will not change

-

The “grain deal” will be extended and the pace of inspections will slow down

-

The “grain deal” will NOT be extended or it will be terminated by non-diplomatic means (military escalation)

We consider the scenario No.3 to be the most probable: grain shipments from Ukrainian ports will continue after March 19, 2023 but the pace of inspections in Bosporus continue to be low. Another factor to pull down Ukrainian exports next months will be the seasonal decline in stocks, primarily in those of barley and wheat. Share of corn in the total grain exports will increase greatly with corn export potential realized only at half.

Full version of the article is available to subscribers of ‘BLACK SEA GRAIN’ Weekly Report by UkrAgroConsult.

Request a free a sample report and apply for subscription here.

Be confident with your business and trade strategy based on professional analysis and forecasts of the Black Sea agri market.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon