Global wheat shipments withstood the shock of Russia’s invasion of Ukraine

When the flow of Ukrainian grain was cut off by Russia’s invasion, there were widespread fears that a global food crisis would ensue. When grains such as corn and sunflower seeds are included, Ukraine’s share in world exports rose to 10 percent. Meanwhile, roughly 35 percent of the world’s population relied on wheat as the primary staple in their diet. Many food-insecure countries were especially vulnerable to disruptions of wheat trade: Ukraine accounted for roughly 67 percent of Lebanon’s wheat imports and 84 percent of Gambia’s.

Wheat prices, already on the rise before the conflict began on Feb. 24, 2022, soared in anticipation of Russia’s occupation or blockade of Ukraine’s Black Sea ports (the yellow line in Figure 1.) But the And there were no major disruptions to global seaborne shipments of wheat, highlighting the resilience of supply chains, according to a forthcoming World Bank analysis.

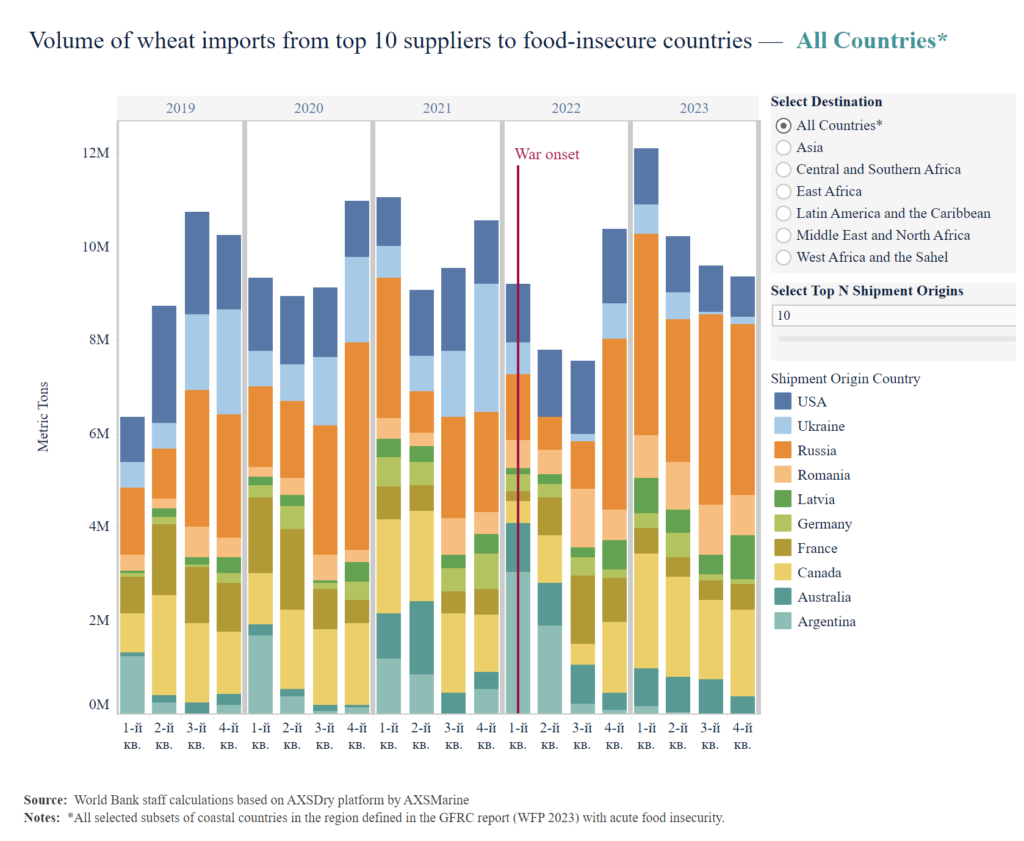

The analysis broke down the share and volume of wheat supplied by the top 10 exporters to countries facing acute food-insecurity as defined by the World Food Program’s Global Report on Food Crises 2023. This grouping assumed that landlocked countries sourced their wheat supplies through ports in the same region.

For a few regions, the outbreak of the war had little impact on volumes of wheat imports. In cases where notable disruptions did occur, countries used various coping strategies – and sometimes a combination of different strategies. These included sourcing wheat from suppliers other than Ukraine and Russia, the world’s No. 1 exporter; substituting imports of other grains, such as buckwheat or sorghum; and relying on supplies of wheat accumulated before the war to ride out temporary shortages.

Figure 1. Wheat imports by countries facing acute food insecurity soon recovered

The impact of the war varied by region. Asia saw the sharpest annual decline in wheat imports from all sourcing countries; in the second quarter of 2022, they dropped by 54 percent from the previous year to the lowest level since 2019. But within six months, imports rebounded roughly to pre-war levels as Asian economies purchased more wheat from Russia and Romania. Romania, traditionally not a significant wheat supplier to Asia, likely served as an outlet for Ukrainian wheat, mostly to circumvent the Russian blockade of Ukraine’s Black Sea ports.

Wheat shipments to West Africa and the Sahel region, which had been declining before the war, were slightly disrupted by the conflict. Prior to the war, about 20 percent of quarterly wheat shipments to the region, on average, were sourced from Russia and about 8 percent from Ukraine. After February 2022, the share of wheat shipped from Russia plunged to 5 percent, and shipments from Ukraine stopped completely by the end of August 2023. Wheat shipments from Poland and Lithuania boosted the region’s imports in the last months of 2022 and in the first three quarters of 2023; these were likely shipments of Ukrainian grain exported through so-called Solidarity Lanes initiated by the European Union in May 2022.

Like the West Africa and the Sahel region, Central and Southern Africa was able to diversify its importers by using Solidarity Lanes. Countries with acute food insecurity experienced short-term reductions in the amount of imported wheat but were quickly able to find new suppliers as shipments from Ukraine ceased entirely in the second quarter of 2022, after the outbreak of the war. Alternative sources included Argentina, Latvia, Lithuania, and Poland.

Finally, the Middle East and North Africa was the only region where the volume of dry bulk wheat imports was not visibly affected by the conflict in the short run. Imports from Russia had been rising before the war and doubled between the last quarter of 2022 and the first quarter of 2023. Countries also sourced more wheat from Australia, Brazil, Bulgaria, and Romania and reduced shipments from Ukraine. Nevertheless, the long-term effects of price volatility, regional conflicts, and macroeconomic instability might have taken their toll as wheat imports in the last quarter of 2023 dropped to the lowest levels since the second quarter of 2022.

What lessons can be drawn from this analysis? This characteristic of dry bulk shipping contributed to the remarkable resilience of supply chains for wheat and shows the importance of international trade in overcoming shocks to deliveries of essential food staples.

Nevertheless, Options include product diversification strategies; food aid programs to vulnerable populations; and investments in storage, milling, and processing facilities. Last but not least, they should avoid dependence on a single exporter and diversify their sources of supply.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon