Global Food Prices to Remain Elevated Amid War, Costly Energy, La Niña

Food prices, which reached a record earlier this year, have increased food insecurity and raised social tensions. They have also strained the budgets of governments struggling with rising food import bills and diminished capacity to fund extra social protection for the most vulnerable.

To better understand the scale of these unprecedented challenges for global policymakers, we quantify in new research the typical impact of four historically important drivers of food commodity prices. Our analysis, published in October’s special feature box in the latest World Economic Outlook, shows that:

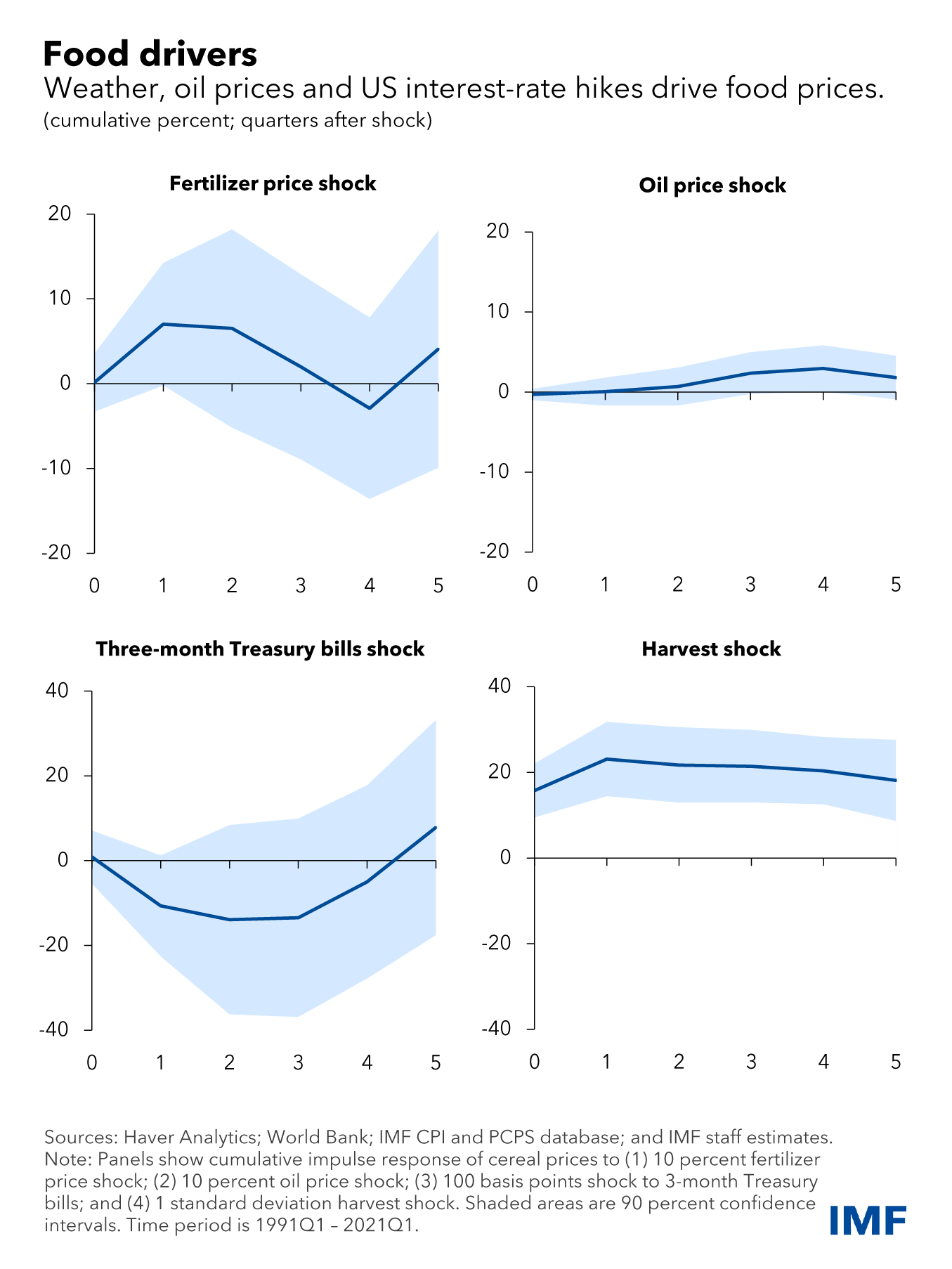

A 1 percent drop in global harvests raises food commodity prices by 8.5 percent.

A 1 percentage point increase in the Federal Reserve’s main interest rate reduces food commodity prices by 13 percent after one quarter.

A 1 percent increase in fertilizer prices, which have climbed recently on the surge in natural gas prices, boosts food commodity prices by 0.45 percent.

A 1 percent increase in oil prices increases food commodity prices by 0.2 percent.

These estimates can be used to better explain recent fluctuations in food prices and help define the outlook as different factors can exert opposing forces.

La Niña weather conditions are forecast to return for a third straight year, bringing below-average water temperatures to the east-central Pacific Ocean, according to the UN’s World Meteorological Organization. Similar three-year periods occurred during the first world food crisis between 1973-76 and again between 1998-2001.

Moreover, the Black Sea Grain Initiative that provides safe export shipping from Ukraine could cause another shock to cereal supplies if it is suspended again by Russia. This alone would reduce global wheat and corn supplies by 1.5 percentage points, relative to current expectations, and in turn raise cereal prices by 10 percent within a year.

In addition, high energy prices raise fuel and fertilizer prices, boosting food production costs, but they also divert output from food to biofuels. Fertilizer prices are double what they were before the pandemic, even after a pullback in recent months.

Around 45 percent of any change in fertilizer prices usually feeds directly into global cereal prices within four quarters, IMF research shows. This suggests that part of the effect of high fertilizer prices may yet fully materialize. In poorer countries, where farmers use fertilizer more sparingly, reduced use may diminish harvests.

In addition to slowing global economic growth, which has a modest direct effect on food prices, central bank interest-rate hikes have significantly eased price pressures. The Federal Reserve, for example, is raising borrowing costs at the fastest pace in two decades. Higher rates tend to discourage inventory holdings and reduce speculative activities in commodity futures markets, thus putting downward pressure on food prices.

Our estimates suggest Fed tightening has already helped lower cereal prices since April and will continue to put downward pressure on prices through the end of next year.

It remains uncertain how the combination of harvest disruptions, energy prices, and monetary policy will play out. Trading in futures markets suggests that wholesale cereal prices will only drop 8 percent next year from the current highs. But our estimates indicate supply constraints could outweigh weakening demand, keeping prices elevated for the next few quarters.

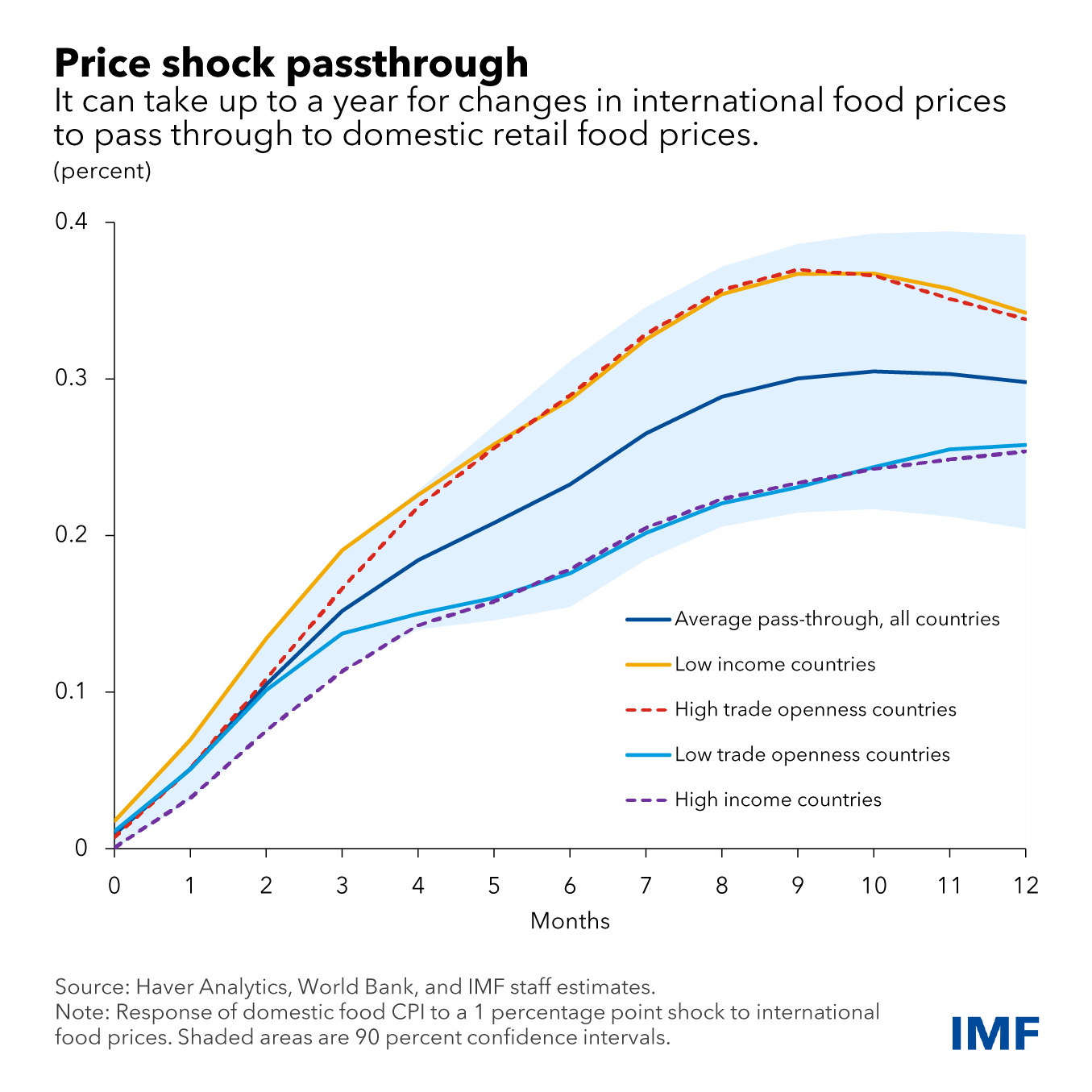

Higher international food prices are estimated to have added 6 percentage points to consumer food inflation in 2022. However, the passthrough to higher domestic retail food prices could take six to 12 months—another reason why, in addition to the recent weakening of emerging market currencies, many people will have to wait for relief from lower commodity prices.

Finally, the risk of food prices increasing again rather than declining during the next couple of quarters remains high. And if these risks weren’t enough, the impact of rising interest rates on food insecurity could be mixed. That’s because a resulting slowdown in economic activity may reduce personal incomes. Combined with still elevated food price levels, this could increase the number of food insecure people.

To defend against new price surges and allow food and fertilizer to flow to those who need it most, it remains vital that international trade remains free. In particular, the Black Sea grain corridor has facilitated cereal exports from Ukraine and brought down prices to pre-invasion levels, mitigating global hunger. It is important that there is also global access to fertilizers by eliminating trade barriers that are limiting global supply, as far as possible.

Countries should allow the increase in global prices to pass through to domestic prices while also increasing targeted social protection spending, as their budget allows. This is necessary to allow price signals to rebalance food markets and at the same time to protect vulnerable families’ purchasing power. External debt relief and grants from international organizations could help finance the expansion of social assistance schemes in developing countries.

To help ease supply tensions, countries should stimulate domestic food production, while avoiding stockpiling and using reserves, especially those that have accumulated higher stock levels. Finally, high fuel prices at the pump have led policymakers to keep or increase the mandates for oil refineries to blend biofuels into their national fuel mix, with the intent of increasing supply. This extra demand on crops to produce feedstock for ethanol and other biofuels puts more pressure on food prices. Reducing biofuel mixing mandates would help lessen the impact of higher demand for biofuels on food prices.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon