Feedgrain Focus: Export demand, trade shorts lift prices

PRICES for wheat and barley have firmed in the past week, as heady export demand supported by some domestic trade shorts book tonnage for delivery in coming weeks.

In the longer term, falling numbers of cattle on feed are expected to temper demand for barley in the north, where a big sorghum crop is expected to start hitting the market in March.

Internationally, Australian wheat and barley are at very low basis levels, and have not factored in the full leap in world values fuelled by last week’s USDA reports, and by looming Russian export taxes.

This means domestic consumers are having to buy in a firming market, but are limiting their coverage in the hope of an easing in prices in the near term.

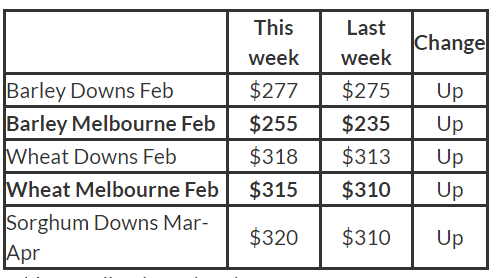

Table 1: Indicative prices in AUD per tonne.

Feedlot demand subdued

Numbers of cattle on feed are believed to be contracting, a function of feedlots being unable to buy enough feeder cattle to sustain numbers.

Feeder cattle are in very short supply, and trading at record prices as feedlots compete with restockers who are looking for mouths to put on to mostly plentiful paddock feed.

Trade sources report numbers of cattle at some feedlots has fallen to 50-80 per cent of capacity in recent months, and this has automatically extended their grain coverage.

“Consumer interest in buying grain now is quite low,” one northern trader said.

“All the activity we’re seeing now is coming from the trade covering short positions.”

Some feedlots had advanced their coverage earlier this month out to late February, but with less mouths to feed, now find themselves covered well into April.

“Growers are wanting to sell some March-April barley now, but we just don’t need it.”

Exports fuel southern strength

The basis price on Australian wheat and barley is extremely low.

“We’re at multi-year lows for basis, and we’ve still only priced in about half of the rise that global cash markets have,” GeoCommodities broker principal Brad Knight said.

The cheap basis and the sharp rise in export value have driven January/February demand in south eastern Australia. It’s coincided with regular monthly stockfeed processor demand, whose modest risk appetite sees them buying grain only a month or two ahead of themselves.

“Domestic processors can’t go long, so they’re buying what they need to keep them going.”

“Domestic consumers went into harvest on the short side because they knew there was a big crop, and now they’ve found barley is up $20 on where they could have been buying at harvest.”

They are facing competition from container packers chasing tonnage on short notice, as a limited number of boxes become available, and from exporters looking for final parcels to make up bulk shipments.

In southern New South Wales, Godde’s Grain trader Peter Gerhardy said grower selling was limited.

“There’s a little bit of coming on to the market from temporary storages like silo bags and field bins, and some from grain sites,” Mr Gerhardy said.

“It’s a typical January.”

The difference is that prices are climbing.

“Markets have firmed based on the export movements, and on logistics.

“Logistics is becoming a bit of a nightmare.

“Containers are very scarce, and the packers don’t get a lot of notice when they’re arriving.”

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon