Drought threatens hopes French wheat could ease Ukraine shortfall

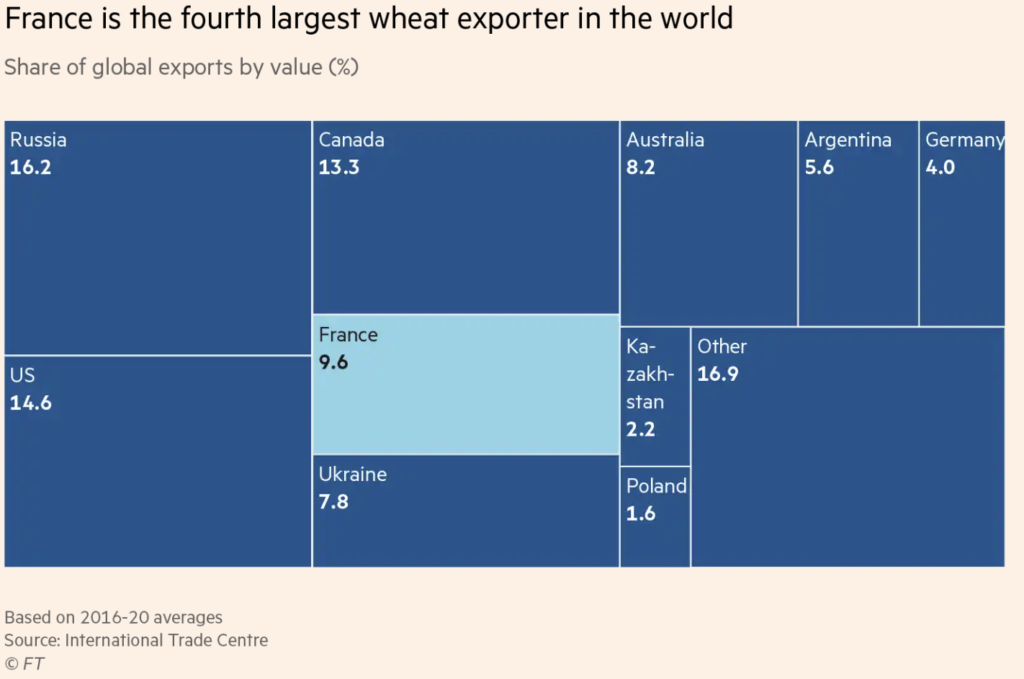

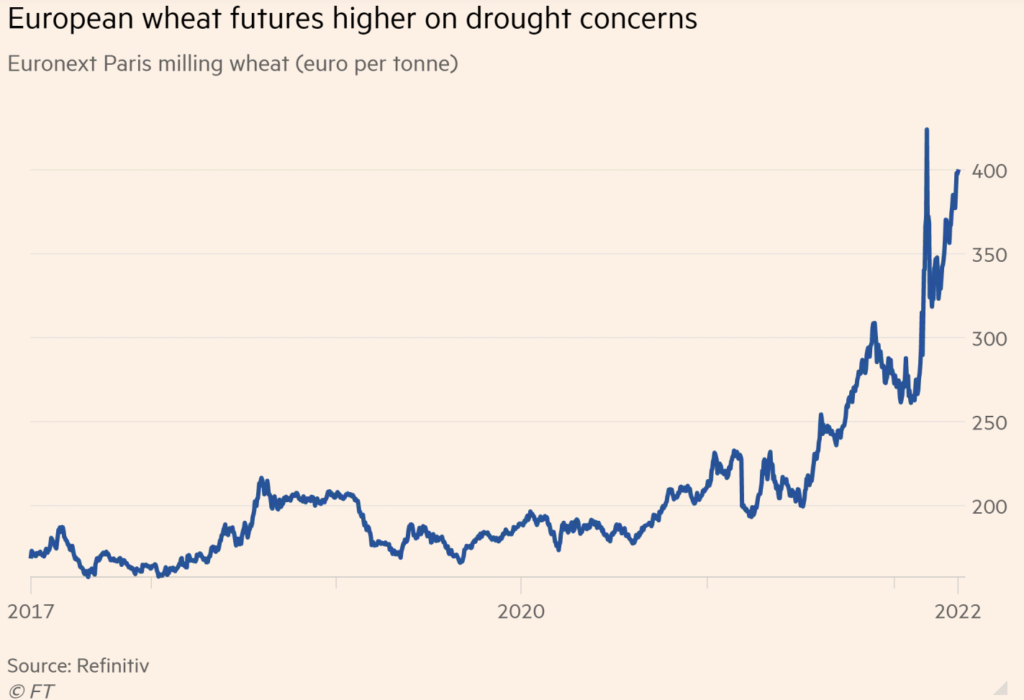

France’s rich wheat fields seemed an obvious partial solution to the grain shortages caused by Russia’s invasion of Ukraine, the traditional “bread basket” of Europe. But the EU’s biggest wheat exporter is facing challenges of its own. Low rainfall this year has brought the threat of drought, triggering warnings of a hit to output and exports and raising fears of a further squeeze to global supplies. “There is a huge amount of dependency on France’s crop,” said Kona Haque, head of research at commodities broker ED&F Man. France, she said, was seen as a reliable fallback in Europe after the Ukraine war pushed up wheat prices in markets that were already under pressure. “France is a very big producer and exporter of wheat, and almost all of it is winter wheat,” said Christian Huyghe, scientific director for agriculture at France’s national institute of agronomic research. “[The plants] use a lot of water and they are at their maximum growth period.” Crucially, forecasters are expecting dry, hot weather at the time when ears of wheat and barley are formed and rain is needed. “The next 10 days will be pretty critical,” said Huyghe.

Christiane Lambert, who heads the National Federation of Agricultural Holders’ Unions, said the danger was that drought would mean “very small ears” and lower output in the summer’s harvest. France produces about 35mn tonnes of wheat every year, of which it exports roughly half. Before the war disrupted activity in Ukraine’s wheat fields and its Black Sea ports, the country exported about 20mn tonnes in 2021 and, together with Russia, accounted for a quarter of globally traded wheat. The worries about French output come as concerns mount over supplies from other big wheat producers. India, which had increased its wheat exports to markets left short by the Ukraine war, is now struggling with a heatwave, raising the possibility of an official export ban, which would affect global food security. In the US, 30 out of 50 states are experiencing droughts, as are Canada’s Alberta and Saskatchewan, both large grain producing provinces. Traders are concerned that the great plains of the world’s second and third-largest exporters are still too dry.

Another big question is whether China, the world’s largest wheat producer, can produce sufficient levels of the grain amid planting delays given the bad weather earlier this year and Covid-19 lockdowns. The importance of this year’s spring weather in wheat-exporting countries such as France is underlined by the volatility of wheat prices, which — to the alarm of importers in the Middle East, where bread is a staple — have soared in the aftermath of the Russian invasion of Ukraine. Egypt, the world’s largest wheat importer, has historically relied on supplies shipped from the Black Sea, now disrupted by the war. After an official visit to Cairo from French finance minister Bruno Le Maire in March, Egypt’s prime minister Mostafa Madbouly said the north African country was counting on France to become a replacement supplier. With their eye on crop prices since last year, some French farmers have decided to plant more wheat at the expense of other crops such as corn and potatoes, but now they are worrying about the latest spell of dry weather.

Basile Faucheux, a cereal producer of the Loiret region, south of Paris, said in the worst case his production might take a 30 to 50 per cent hit. Any damage to crops could not be reversed later in the season, he explained, but even some rain would help. “If it rains in the next 10 days, we’ll only lose about 5 per cent of the harvest, which is not dramatic.” Big commercial farmers typically safeguard their wheat crops by irrigating the fields, but this year they have had to start doing so much earlier than usual, according to Huyghe, and in some areas groundwater is depleted and there are official restrictions on agricultural use. Even before the start of summer, official warnings or water restrictions from the environment ministry are already in place in all or part of 15 of France’s 96 départements, excluding those overseas.

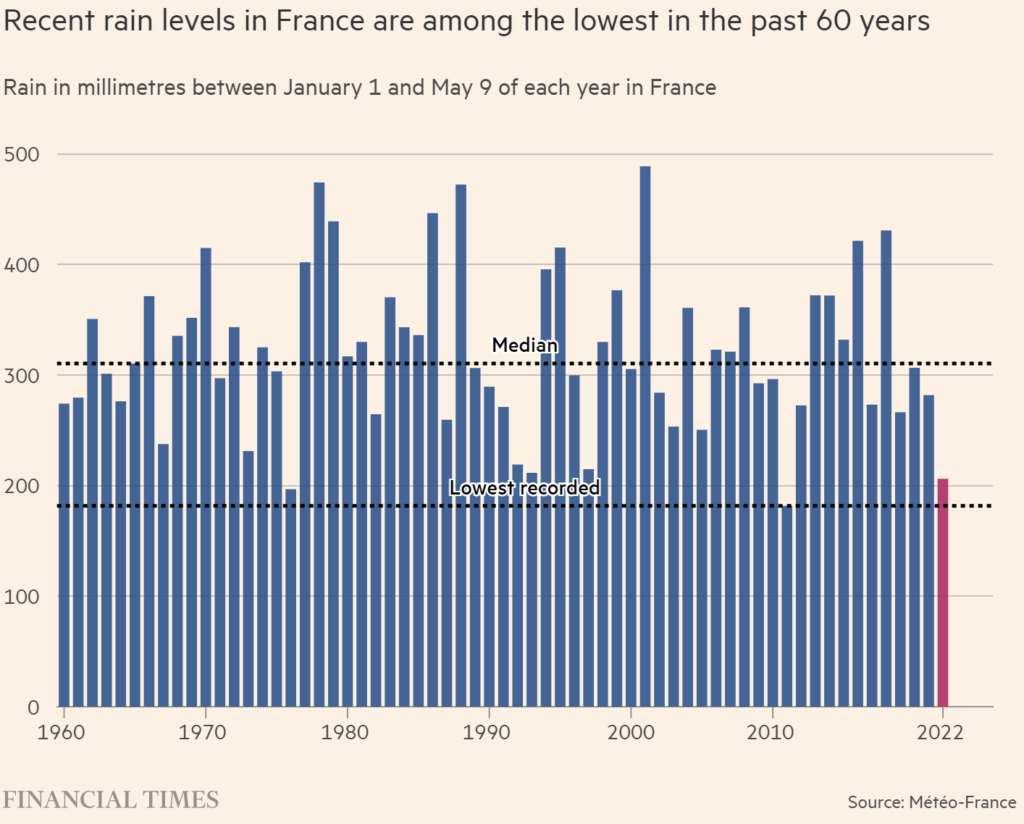

Dry summers and droughts are increasingly frequent in France. According to Météo France, increased evaporation resulting from hotter temperatures generated by climate change makes soils drier for longer periods of time. This year, however, it is still too early to be certain of the impact on crops from the rainfall deficit so far. Traders in wheat futures would be on “high alert” checking the weather from week to week, said Haque. “I don’t think it’s going to be a disaster but the market is so tense, it can lead to volatile market pricing,” she said.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon