Devaluation: Nigeria to Import $100m Palm Oil From Malaysia, Others

To meet expanding local demand, Nigeria will spend up to $100 million on the importation of palm oil in 2023, going by available data from the National Bureau of Statistics (NBS). The figure is based on the value of the imported commodity in the past two years at the average cost of N25 billion in six months, or N50 billion per year.

In its quarterly ‘Foreign Trade in Statistics’ reports, the NBS showed that imported (crude) palm oil, which falls under agricultural products, originated from the Asian countries of Malaysia, Indonesia, Singapore, China, India and West Africa Cote d’Ivoire.

Nigeria imported palm oil to the tune of N28.16 billion in the first six months of 2022, as the value of agricultural commodities shipped into the country maintained an upward trend.

Palm oil falls under the nation’s foreign exchange restrictions; it is among the 43 import items banned by the Central bank of Nigeria (CBN) for Forex Exchange. This implies that importers sourced their foreign exchange from alternative channels such as the parallel market where the Naira exchanged N750/$ against N467/$ in the then official window.

The CBN on June 14, 2023 announced the unification of both windows in a major forex reform that saw the naira depreciate up to N770/$. This has spiked inflation to an all-time high of 22.42 percent as at May 2023, according to NBS as indications of imminent depreciation of Naira was rife following pronouncements by the new government.

The apex bank in June announced that the 43 items restricted from accessing Foreign Exchange from the official window remain banned from the Investors and Exporters (I and E) window. This means the restriction of foreign exchange allocation for the importation of the 43 items, which include palm oil, still stands.

“With the new forex regime, palm oil import will now increase because liquidity has increased and access to forex will be easier unlike before. Again, there will be increased activities as manufacturing picks up, following the forex reform, which implies that importation of palm oil could hit $100 million this year,” said James Obiahun, an industrialist.

At N750/$, N50 billion would exchange for $67 million; given the unification of the forex windows which has increased the daily turnover from about $75 million (before the reform) to as much as $300 million, the improved liquidity will avail importers easier access to forex for importations.

Data from the NBS in its ‘Foreign Trade in Goods Statistics Report’ for the second quarter of 2022 showed that the figure represents a 5.2 percent increase over the corresponding period of 2021 which recorded a value of N26.77 billion.

The report published on the official Website of the nation’s statistical bureau further showed that palm oil importation in Q2 2022 was N14.64 billion against N13.52 billion in the previous quarter, representing an increase of 8.3 percent. But increased demand has since spiked the value of importation of the commodity according to industry sources. The commodity which was classified as ‘Crude Palm Oil’ imported mainly from West Africa and Asia will be on the increase.

The country imported palm oil valued at N14.64 billion from Cote d’Ivoire in Q2 2022, while Malaysia and China supplied N13.50 billion and N0.02 billion of the commodity respectively in Q1 2022. In Q2 2021, Africa’s biggest economy imported N15.09 billion of palm oil from Singapore and N11.68 billion from India totaling N26.77 billion.

Palm oil is a highly sought commodity among manufacturing and processing firms which use it as raw material for the production of various consumer and industrial goods.

The CEO, Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, said that the palm oil produced in Nigeria is grossly inadequate, adding that the users would pay any amount to bring in the commodity if it would boost their margins.

“When products are expensive, it has a way of benefiting the producers because they will adjust their prices to maximize their profit”, Yusuf, immediate past director-general, Lagos Chamber of Commerce and Industry (LCCI) told THEWILL in a telephone chat.

An operator of a medium-enterprise palm oil processing firm, Emmanuel Ebong said the NBS figures do not reflect the actual value of the commodity that is shipped into the country. “A large quantity of palm oil is smuggled across the borders, particularly from Cameroun and Benin Republic. It is a huge business among the inland waterway transporters plying between Nigeria and the neighbouring countries. They are the real suppliers to the large manufacturing firms using the commodity”.

The deputy director, department of agriculture in the Ministry of Agriculture and Rural Development, Benard Okata, said Nigeria is spending about $500 million annually on oil palm importation in order to complement existing gaps in the sector.

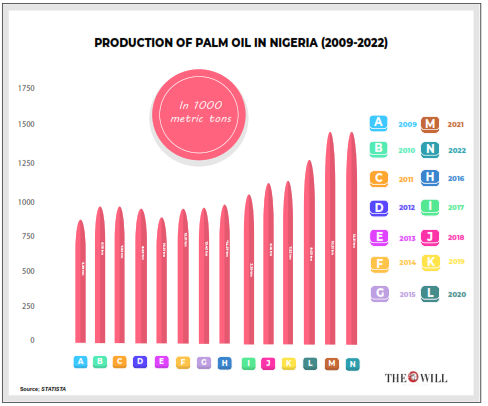

Okata, who made this remark at the national workshop on oil palm organised by Solidaridad, an international non-governmental organisation in Abuja in November 2020, said that Nigeria’s current local requirement for palm oil generally is about three million metric tonnes, but that it is producing only about 1.02 metric tonnes of oil palm.

“So, there is a gap,” he said. “We import to make up for this gap, and Nigeria is spending about $500m annually for this importation up till now,”

He recalled that the former governor, Central Bank of Nigeria (CBN), Godwin Emefiele, had expressed sadness that Nigeria was still importing palm oil in spite of the sufficient arable land in the South-South and South-East regions of the country to produce it.

The agriculture coordinator, Okomu Oil Palm Company, Billy Ghansah, had said at the occasion that for Nigeria to fill the existing gaps in its palm oil production, there is a need to plant about 100,000 hectares of oil palm.

Debunking the claim that the Asian countries came to pick the palm seeds from Nigeria, the agricultural specialist said the basic cultivation strategy of oil palm was developed in Africa, but Nigeria didn’t take advantage of it/. He said the Asians took over, such that many think that they came to pick the seeds from here. “They didn’t,” he said, “rather they (Asians) made use of what they had and improved it.”

Also, a Senior Climate Specialist for Africa at Solidaridad, who doubles as Country Technical Lead, Nigeria, Sam Ogala, affirmed that Nigeria was not meeting its domestic demand for oil palm.

“This country is spending around $500m annually to import oil palm. That shows you the huge gap, and it’s because we are not meeting local demand. In the early 1960s before the oil boom, Nigeria was exporting oil palm, but after that oil boom, we started importing, and all forms of oil palm are finding their way to the Nigerian market,” he added

Top producers of palm oil in Nigeria Nigerian States that are considered to be the largest producers of palm oil are Akwa-Ibom, Abia, Rivers, Edo, Imo, Ondo, Bayelsa, Cross River and Delta. But the state governments have not made significant efforts towards maximizing the potential of palm oil production in their areas.

Palm oil has numerous usage globally which include: Edible Oil, Bio-Diesel, Lubricants, Cosmetics, and other applications – household cooking, food and beverages, oleo Chemicals, personal care, animal feed and bio-fuel. Global production of palm oil has increased rapidly since the 1990s, with plantations in Indonesia and Malaysia supplying around 85 percent of the global trade.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon