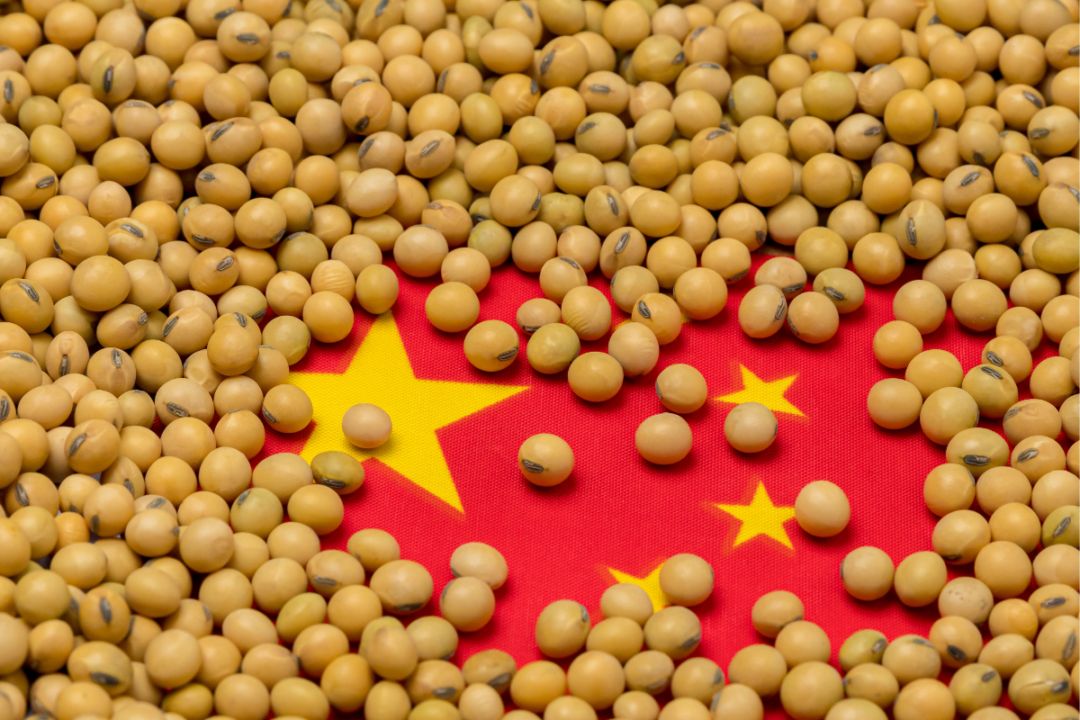

China’s soy imports slowed by stricter customs checks

China’s April imports of soybeans fell 10% from a year earlier after stricter customs checks delayed cargoes.

The world’s top soybean buyer brought in 7.26 million tonnes of the oilseed last month, significantly less than the 9 million tonnes expected by traders.

Analysts and traders attributed the drop to new customs procedures that delayed the discharging of soybean cargoes for up to two weeks.

“The strengthened inspection at customs continued during the whole month of April and that resulted in lower imports than expected,” said Shanghai JC Intelligence analyst Rosa Wang.

Soybeans are crushed to make protein-rich soybean meal, a major ingredient in animal feed, as well as oil for cooking.

Crushers had stepped up purchases since late last year to meet an expected recovery in demand from China’s livestock sector.

However, Chinese customs in April began a requirement for traders to wait for results of quarantine checks before taking delivery of their soybeans up to two weeks later, said Dayue Futures analyst Wang Mingwei.

Traders or crushers were able previously to take delivery into their own warehouses while awaiting the inspection permit before starting processing, said an industry official briefed on the issue.

Now cargoes are held at customs warehouses until the permit is granted.

The official requested anonymity because of the sensitivity of the topic for the trade.

The change has not been announced publicly and China’s General Administration of Customs did not respond to a fax seeking comment.

The delays have become “a big issue” for importers, said one Singapore-based trader at a company with soybean processing plants in China.

“Waiting time for ships has gone up to 15 days versus no waiting at all in normal times. Importers are having to pay demurrage costs,” he said.

While costs have risen, soybean demand is falling short of market expectations. Hog farmers have been losing money since the start of the year, hurting demand for soymeal.

The delays have also pushed up soymeal cash prices in China, said one Beijing-based trader, with the price in crushing hub Rizhao rising 13% in April to 4,320 yuan a tonne.

Higher prices will further reduce demand from farmers, he added.

With April soybeans delayed until May unloading, May imports should return to high levels, probably between 9 million and 10 million tonnes, Wang said.

Soybean arrivals for the first four months of the year reached 30.29 million tonnes, up 6.8% year on year, the data showed.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon