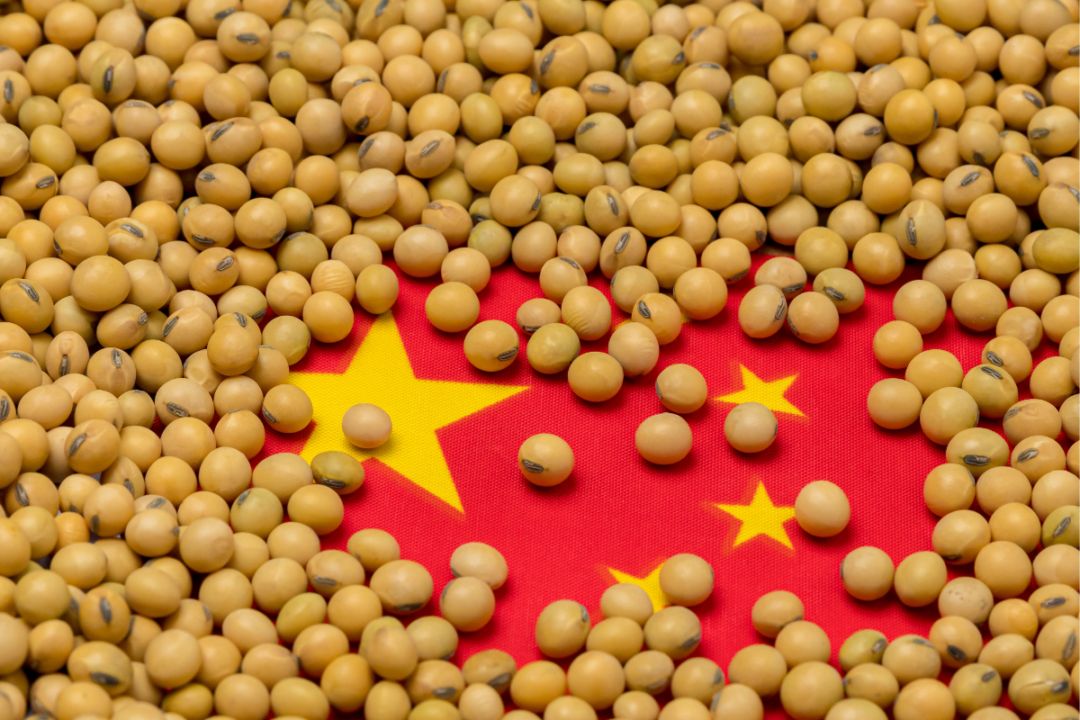

China’s near term domestic soybean supply seen falling on stricter customs checks

Soybean supply in China, the world’s top importer of the oilseed, is expected to decline in the coming weeks as stricter customs inspections since April lead to longer-than-expected waiting times and demand disruption, several traders told S&P Global Commodity Insights.

Since the first week of April, the average time to inspect a vessel by China’s customs leapt to over 20 days compared with the standard duration of 3-4 days, resulting in a decline in the import of the yellow oilseed last month.

China’s soybean imports fell 10% on the year to 7.26 million mt in April, customs department data showed.

According to traders, Chinese customs officials toughened quality inspection norms of imported soybeans prior to local traders collecting their cargoes. However, the Ministry of Agriculture and Rural Affairs has yet to provide an official statement of this procedure.

When contacted, the ministry did not immediately respond to S&P Global’s request for comment on the matter. A reduction in the availability of the yellow oilseed in China started to pressure domestic crushing and pig breeding operations, commodity analysts said.

China typically imports 95 million-97 million mt of soybeans in a calendar year, mostly from Brazil and the US. Over 80% of the imported beans are processed into protein-rich soybean meal-based animal feed, catering primarily to its vast pork industry.

Soybean meal prices in China rose as much as 14% since April 1 to Yuan 4,500/mt as of May 10 amid lower crushing and hog breeders’ thinning margins, traders said. Prices, however, have since pared recent gains and stood at Yuan 3,780/mt on May 29, down 8% on the week, they added.

The introduction of stricter customs inspection norms was likely an attempt by the government to appease domestic soybean farmers, China-based traders said.

Chinese soybean farmers complained about low demand for domestically grown beans by the crushing sector, as crushers preferred to purchasebetter quality imported beans from Brazil or the US, one of the traders said.

Domestically produced soybean inventory had risen in China, in regions such as the northeast, another trader said, adding that stricter import inspection norms will force crushers to buy locally produced soybeans after they depleted their older stock.

The new norms disrupted soybean demand for forward shipment in China as local crushers look to avoid demurrage costs, a third China-based trader said, leading to a notable slide in basis prices.

Demurrage is a charge that a merchant pays to use a container within a terminal beyond the free time period.

Platts assessed SOYBEX CFR China for July deliveries at $513.03/mt May 30, down 9% since April 3, S&P Global data showed.

Additional factors such as a swift US soybean planting pace and a poor macroeconomic outlook for China also led to a decline in the oilseed’s price. But delays caused by the change in customs norms have been the biggest dampener for soybean demand and prices, traders said.

Commodity analysts said they have not seen the pace of customs quality inspections improve so far in May, which points to yet another month of lower-than-expected soybeans imports and tighter soybean meal availability in China, a Shanghai-based agricultural consultancy said.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon