Cereal production, utilization, stocks, and trade all forecast to contract in 2022/23 – FAO

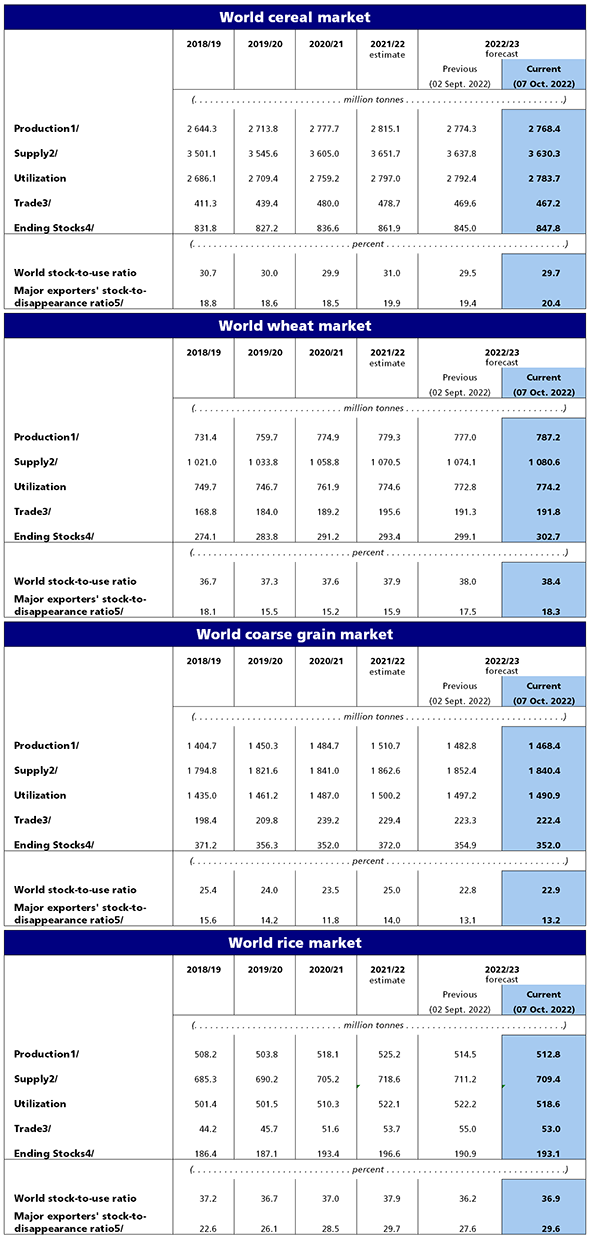

Pegged at 2 768 million tonnes, FAO’s latest forecast for global cereal production in 2022 has been lowered for a second consecutive month, down 5.9 million tonnes from September and now 1.7 percent below the 2021 outturn. A lower global coarse grain production forecast makes up the bulk of this month’s overall cutback, as adverse weather continued to curb yield prospects in major producing countries. Standing at 1 468 million tonnes, the 2022 world coarse grain production forecast is 14.3 million tonnes lower month-on-month and down 2.8 percent year-on-year. Most of the monthly decrease is linked to reduced maize production prospects in the United States of America, as deficient rainfall resulted in further cuts to maize yield estimates and a small downward revision to the area planted. Forecasts for maize production in the European Union and the Republic of Moldova were also lowered, albeit by smaller amounts, as the drier-than-usual conditions that have characterized the season resulted in additional reductions to yield expectations. In Brazil, maize production was cut moderately based on recently released official data, however, the national output remains at a record high. Partly offsetting these downward adjustments, the forecast for global barley production was raised by 2.5 million tonnes, mostly to reflect better prospects in the Russian Federation, and now stands at 147.9 million tonnes, 1.7 percent higher on a yearly basis. In Ukraine, the production forecast for coarse grains remains unchanged from last month at 33.1 million tonnes, 38 percent lower year-on-year. Following a 1.7 million tonne reduction since September, world rice production in 2022 is now seen in the order of 512.8 million tonnes (milled basis), down 2.4 percent from the 2021 all-time high, but still an above-average crop. The revision primarily stems from more subdued output prospects in China, where prolonged summer dryness and high temperatures affected crops along the Yangtze River basin, and in Pakistan, on account of the recent severe flooding. Combined with smaller downward revisions for other countries, these cuts outweighed raised forecasts for production in the Islamic Republic of Iran, Thailand and a few West African producers. By contrast to the coarse grain and rice outlooks, the global wheat production forecast for 2022 was raised since September by 10.2 million tonnes and is now expected to reach a new record high of 787.2 million tonnes, up 1.0 percent from last year. Better-than-expected harvest results in the European Union, predominantly related to improved yields of the soft wheat crop, and in the Russian Federation, owing to conducive weather, represent the largest proportion of this month’s increase. Good soil moisture at planting time and a favourable rainfall outlook have also bolstered Australia’s production outlook, pointing to a potential second largest wheat output on record in 2022, following the all-time high in 2021. These revisions more than offset a minor cut to Argentina’s wheat forecast, where limited rainfall amounts slightly degraded crop conditions, portending to potentially lower yields. In Ukraine, the wheat production estimate remains the same this month at 20 million tonnes, also 38 percent down from the preceding year.

World cereal utilization in 2022/23 is forecast at 2 784 million tonnes, down 8.7 million tonnes since September and 0.5 percent below the 2021/22 level. In line with the reduced production forecasts, this month’s downward revision is led by a 6.4-million-tonne cut in the coarse grains utilization forecast, which is now pegged at 1 491 million tonnes, down 0.6 percent from the previous season’s level, stemming almost entirely from a foreseen reduction in feed use. Maize feed use is seen falling especially in the European Union and the United States of America, where supplies are tighter due to reduced domestic harvests, as well as in Canada, reflecting a retreat from last season’s elevated level to compensate for tighter supplies of other grains. Feed use of barley is also forecast to fall in 2022/23, mostly on lower feed use in Morocco as a result of lower production, while an expected fall in China makes up the bulk of a forecast decline in global sorghum feed use. FAO has also lowered its forecast for world rice utilization in 2022/23 by 3.6 million tonnes since September, to 518.6 million tonnes. This level would represent a 0.7 percent decline from the 2021/22 peak, reflecting expectations of non-food uses of rice declining from the above-normal levels registered the previous season, while food intake should largely keep pace with population growth. Forecast at 774 million tonnes, total wheat utilization is foreseen to remain near the 2021/22 level following an upward revision of 1.3 million tonnes since September, driven by higher-than-previously-expected feed use of wheat in the European Union, as tighter supplies and higher domestic prices of maize are seen shifting demand to wheat.

Despite an upward revision of 2.9 million tonnes this month, world cereal stocks by the close of seasons in 2023 are still forecast to contract by 1.6 percent below their opening level, down to 848 million tonnes. Based on the latest stocks and utilization forecasts, the world cereals stocks-to-use ratio in 2022/23 stands at 29.7 percent, lower than the 31.0 percent ratio in 2021/22 but still relatively high from a historical perspective. The anticipated fall in total cereal stocks is mainly attributed to a forecast 5.4 percent decline in global coarse grain inventories from their opening levels, to 352 million tonnes, down 2.9 million tonnes since the previous forecast. Global maize stocks in particular are seen headed toward a sharp contraction of 5.3 percent in 2022/23, led by large maize inventory drawdowns anticipated in the European Union and the United States of America due to falls in production, as well as in China on account of higher expected domestic feed use of maize. A 2.1 million tonne upward revision since September has raised FAO’s forecast for world rice stocks at the end of the 2022/23 marketing year to 193.1 million tonnes. At this level, they would be down 1.8 percent from the 2021/22 all-time high, but still the third largest on record. This relative abundance is anticipated to be sustained by some forecast build-ups in China and India. The outlook is less buoyant elsewhere, with aggregate reserves held by all other countries seen falling 8.2 percent year-on-year to a three-year low of 50.1 million tonnes. By contrast to expectations for coarse grains and rice, global wheat inventories are forecast to rise by 3.2 percent above their opening levels, to reach 303 million tonnes, up 3.6 million tonnes since the previous forecast. Better production prospects have lifted prospects for higher wheat inventories in the Russian Federation, where, along with Canada, China and Ukraine, much of the projected wheat inventory growth is likely to be concentrated.

FAO’s forecast for global cereals trade in 2022/23 was lowered this month by 2.3 million tonnes, down to 467 million tonnes, pointing to a 2.4 percent decline from the 2021/22 level, with foreseen contractions in trade of all major cereals. Coarse grains trade in 2022/23 (July/June) is seen declining by 3.0 percent from 2021/22, to 222 million tonnes, nearly unchanged since the previous forecast. Global maize trade is likely to drop only marginally (0.5 percent) below the 2021/22 level, reflecting lower import demand from China in particular, and a fall in exports from Argentina, Ukraine and the United States of America. While smaller maize harvests underpin the decline in the export forecasts for all three major exporters, additionally domestic inflation-control measures in Argentina, the impact of war-related disruptions in Ukraine and uncompetitive prices due to a strong United States dollar are also seen hindering sales for each country, respectively. Lower import demand from China, along with smaller barley purchases by Turkey on account of higher production, is also a main driver behind the forecast declines in global trade of barley and sorghum in 2022/23, down, respectively, 13.5 percent and 14.0 percent from their 2021/22 levels. On the export side, lower production is seen leading to a fall in exports of sorghum from the United States of America and of barley from Argentina and Ukraine, in addition to export capacity limitations related to the war in the latter. While nearly unchanged from last month, world wheat trade is forecast to fall in 2022/23 (July/June) by 1.9 percent below the 2021/22 record level to 192 million tonnes. Expected declines in wheat exports from Argentina, India and especially Ukraine from their previous season’s levels will likely outweigh foreseen greater shipments by Canada, the European Union and the Russian Federation, boosted by higher supplies. On the importer side, higher production is seen reducing purchases by China, the Islamic Republic of Iran and Kazakhstan. International trade in rice is now predicted to subside somewhat in 2023 (January/December) at 53.0 million tonnes, down 1.4 percent from the 2022 forecast level, reflecting somewhat tighter exportable availabilities, combined with uncertainties surrounding trade policies and currency movements in importing countries.

Summary Tables

|

|

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon