Canadian wheat and barley areas fall: Grain market daily

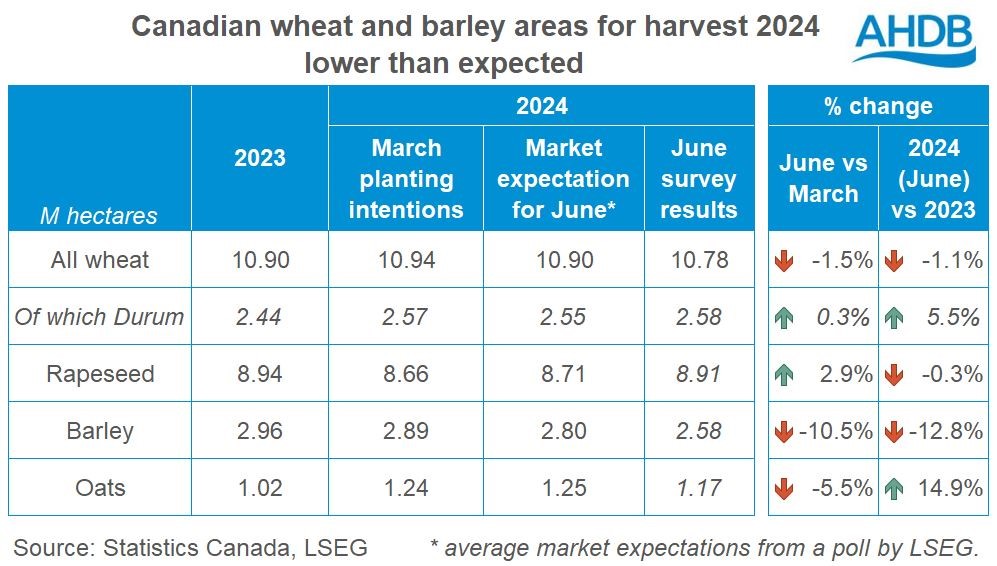

Canadian farmers planted less wheat and barley for harvest 2024 than they had intended in March, and than the market expected, supporting prices yesterday.

The market had expected the Canadian planted wheat and oat areas to be similar to the March survey of planting intentions (LSEG). LSEG also reported expectations for a small increase (+0.6%) to the canola (rapeseed) area compared to March’s intentions, with a decline for barley (-2.9%).

However, the survey results from Statistics Canada, released yesterday, were surprising. They showed Canadian farmers had planted 1.5% less wheat than they had intended in March, along with far less barley (-10.5%) and oats (-5.5%). The smaller than expected wheat area helped support global wheat prices (see above).

Canada is the world’s fourth largest exporter of wheat. The planted area is slightly smaller than 2023 so unless yields rise more than currently expected, this could reduce the predicted recovery in Canadian production. A smaller Canadian crop could further tighten global exportable supplies of wheat, depending on harvest results elsewhere.

However, so far, current crop conditions are generally good, though crops are behind typical development stages in some areas. LSEG expects the forecast for a cool and damp start to July to be favourable for yield prospects, though it will not help crops progress.

Canada’s also one the UK’s top suppliers of wheat, often high protein milling wheat. So, the fortunes of the Canadian crop can impact milling premiums here.

While the Canadian barley area was already expected to dip year-on-year, the 2024 area is now much sharply lower, at a seven year low. So, even with a recovery in yields from last year’s drought affected levels, Canadian barley production looks set to fall in 2024. Depending on the extent of the recovery in yields and results elsewhere, this could reduce the expected global barley surplus in 2024. In turn, this could reduce the pressure on barley prices compared to other feed grains depending on what happens elsewhere.

Even before the latest data, Canadian oat supplies in 2024/25 already looked tight due to very low carry-over stocks from 2023/24 (Agriculture & Agri-Food Canada, AAFC). As a result of the smaller rise in planted area, yields will need to be well-above normal to maintain the current production forecast. Without such yields, this could tighten Canadian and so global oat supplies.

Canada is the world’s top exporter of rapeseed (USDA). Yesterday, Statistics Canada reported a much larger change in the rapeseed area than the market had expected. The new data means the 2024 area is almost unchanged from 2023 levels and could support production from AAFC’s June figure of 18.1 Mt. However, other forecasters, such and the USDA and OilWorld.biz already include larger crop sizes for Canada, which could limit the impact of the new data.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon