Australia: market-access issues hinder growth in pulse sector

Price volatility due to the lack of diversity in markets is making Australian pulses a less attractive option for growers, according to Premium Grain Handlers managing director John Orr.

Mr Orr told the Grains Industry of Western Australia (GIWA) Pulse Forum on Wednesday that these market issues have been compounded by container supply issues.

Based in WA, Premium Grain Handlers stores, processes and packs grain into containers for export from Fremantle.

Mr Orr said the incoming Federal Government has created hope that improved access to some markets may be possible in the future.

He said China as well as other markets in Asia provided huge opportunities for Australian pulses, especially in human consumption; however, access was still limited.

“What we are seeing now is a massive increase in opportunities for pulses for food in the south-east and north-east Asia region – China, Korea, even Indonesia and Malaysia,” Mr Orr said.

“The opportunities in this region for our pulses is massive…and a lot that is the snack food market.

“The difficulty we are having in there is political.

“Why our [former] Federal Government decided it was a good idea to start war-mongering with our trade friends there is really hard to fathom; that is absolutely suicidal and biting the hand that feeds you, and did a lot of damage to our industry.

“Fortunately, we are seeing the new Federal Government with a much better attitude and so hopefully these relationships will improve in the future.”

Mr Orr said chickpeas were an example of a commodity which would have opportunities in China if market access was improved.

“We still can’t get chickpeas into China and, when there is not even a negotiating relationship with these people, we are not going to.

“But, they are buying chickpeas that are being shipped from Australia to India into the free trade zones and trans-shipping them from India into China and with shipping costs where they are, that tells you how good the opportunities is, if we were able to go directly into China.

“The demand is going nuts, much more than our capability to produce.

“We have some exciting stuff there in the future but it relies on our Federal Government to improve these relationships so that we can capitalise on it.”

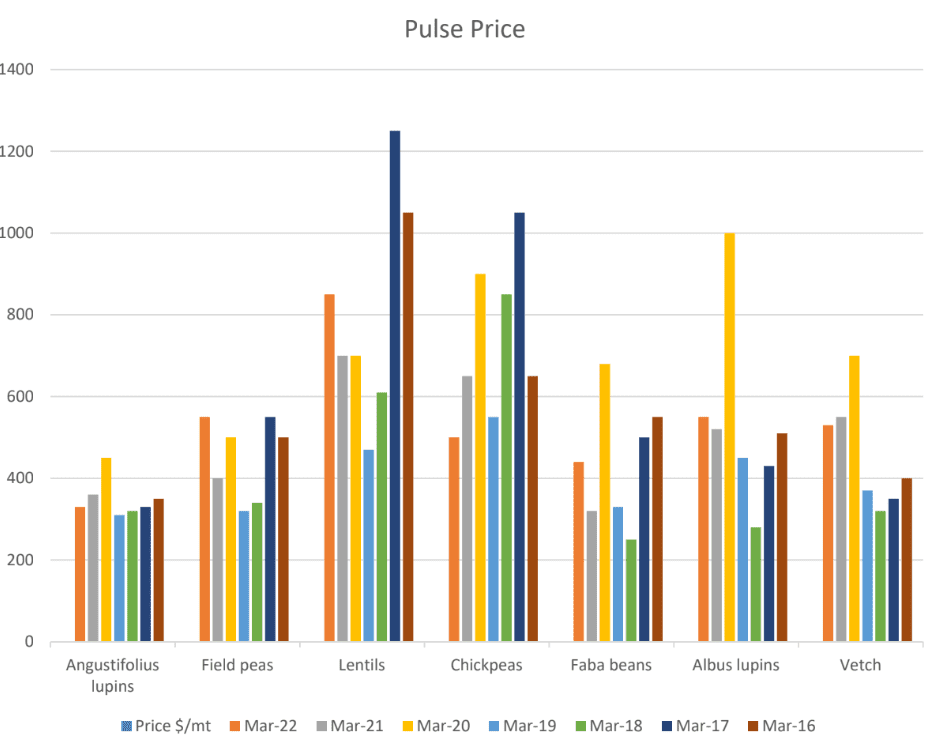

Mr Orr said comparing 2016-22 prices demonstrates the volatility of Australian pulses. Graph: John Orr/ Premium Grain Handlers

Australian Export Grains Innovation Centre (AEGIC) markets manager Mary Raynestold the GIWA Pulse Forum that improving access into China and south-east Asia would also provide opportunities for non-traditional pulse uses, such as faba beans for high-value aquaculture feed.

“I think the biggest opportunities for the Australian farmer and faba beans is into China,” Ms Raynes said.

“They have four markets where we can see growth; that is into the food market for snacks, feed, protein isolates, but also the aquaculture industry in China is very profitable and very favourable towards faba beans.”

Ms Raynes said these new and niche feed markets were still the driving force in pulses.

“We have uncertain growth opportunities in traditional food markets, so feed is really where we are going to get some of the biggest uptake in pulses.”

Mr Orr said increasing access to these higher-value human and feed markets could work to reduce the price volatility in markets pulse crops, such as, faba beans and lupins, and make them a more popular option for growers.

He said for this Australian needs to focus outside the traditional food markets of India and the Middle East.

Ms Raynes said now more than ever improving trade-market access would help take advantage of these opportunities into China and south-east Asia.

She said many Australian pulse crops have become reliant on single markets, such as lentils into India, and increasing diversity is important to furthering the industry.

“Trade-market access is becoming increasingly important to our production and to our growers.

“Tariffs play a big impediment into Australian pulse production.

“Where I hope we can see investment is in that technical engagement to help support and prime customers of Australian grains to use more pulse products.”

The current impact of trade market access, supply chain issues and price volatility on the confidence of growers to produce pulses, was clear in the ABARES June Crop Report which forecast a decline in national production of all crops.

Lupins and chickpeas dropped the most with cuts in production of 340,000 tonnes and 400,000t from 2021-22 to 2022-23.

Lentil production declined slightly from 839,000t in 2021-22 to 788,000t in 2022-23, as did faba beans which fell about 100,000t.

One of Australia’s smallest pulse crops, field peas, saw a small decrease from 261,000t in 2021-22 to 238,000t in 2022-23.

Mr Orr said more work needed to be done by governments and industry bodies to make pulses a more attractive crop, so they can compete on some level with wheat, canola and barley.

“If we can work together in these new opportunities, we can help improve the market price for these products, so they compete with those dizzy wheat and canola numbers we are seeing and actually help complement the production of those wheat, canola products in the future and make the whole farming system more sustainable and more profitable.”

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon