Australia: Bumper harvest to challenge supply chain: ANZ

Australia’s current grain harvest, on top of recent bumper crops, could provide a challenge to the capacity of the nation’s grain receival and distribution network for the coming decades, according to ANZ’s latest agri-commodity report.

ANZ head of agribusiness Mark Bennett said this season’s strong winter-crop harvest comes on the back of two years of above-average to record volumes.

“While the national grain crop is once again forecast to be around record levels, it will also mark one of the biggest variations from an annual crop size in decades,” Mr Bennett said.

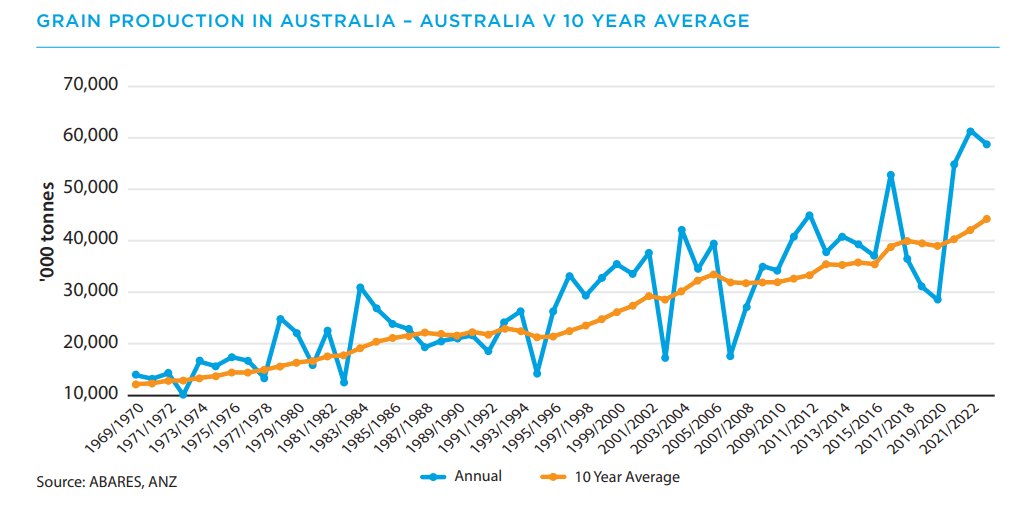

“Statistically, the coming harvest is likely to be the twelfth year in the past 15 years that production has been above the 10-year average.

“Even more notably, working on the latest crop forecasts, this year’s crop could be around 39 percent higher than the 10-year average.

“This would be the sixth-highest difference from the average in over 50 years.”

Mr Bennett said the industry is well versed at dealing with huge swings in grain volumes, as well as delays due to weather events.

“The Australian grain supply chain, including receival centres and port-grain facilities, are all familiar with the volatility of the crop and are usually prepared for a larger-than-average harvest.”

“This is especially important in a nation which sees so much volatility in production, and from which the supply of grain to both domestic and export customers is so essential.”

“This is further complicated by the fact that late-season rains are delaying the harvest in eastern Australia, which prolongs the delivery season and makes logistics less predictable.”

Mr Bennett said this experience should not stop grain handlers, logistics firms and governments from looking at more efficient methods to move larger crop volumes.

He said this conversation would also need to involve growers, who can also assist by storing grain onfarm.

“While Australia remains a world leader in handling volatile crop-production volumes, it is also important that discussion continues on the best possible grain-distribution and export network going forward, which includes the balance of on-farm storage, as well as road and rail transport.”

Mr Bennett said there was still positive outlook for the 2022-23 harvest, despite rainfall and flooding.

“Across the board, aside from the rain, overall production estimates remain strong.”

ABARES forecasts production for the key cereals at 36.6 million tonnes (Mt) for wheat, with barley at 13.4Mt and oats at 1.4Mt.

Mr Bennett said they were all forecast to be reasonably similar in production year on year, reflecting a mix of excellent growing conditions in some regions, with other regions seeing either closer to average conditions, as well as some areas seeing rain-damaged crops.

“In contrast, canola (7.3Mt) and sorghum (2.9Mt) are both forecast to see reasonable increases in production this harvest, driven by a combination of high prices and crop rotation.”

The report said this harvest would be delayed across the country.

This could have the effect of harvesting contractors being more difficult to arrange than normal, as their work is far more widely spread, as well as bottlenecks at grain ports.

The supply chain will also contend with an anticipated increase in quality downgrades for much of this season’s harvest.

If the rain causes an increase in the number or volume of different grades arriving at receival centres, it may cause logistics issues for grain handlers.

This could prove particularly cumbersome, given that receival centres would already be gearing up for the extra challenges of handling a much larger-than-average crop.

This would include the extra pressure of clearing old-crop from facilities.

Read also

Wheat in Southern Brazil Impacted by Dry Weather and Frosts

Oilseed Industry. Leaders and Strategies in the Times of a Great Change

Black Sea & Danube Region: Oilseed and Vegoil Markets Within Ongoing Transfor...

Serbia. The drought will cause extremely high losses for farmers this year

2023/24 Safrinha Corn in Brazil 91% Harvested

Write to us

Our manager will contact you soon